A few things you should know ahead of registering your business entity: You should try to answer as many questions as possible before moving forward. Information provided on Forbes Advisor is for educational purposes only.  WebThere are a few rules that South Carolina Limited Liability Companies must follow in order to register a name.

WebThere are a few rules that South Carolina Limited Liability Companies must follow in order to register a name.  Section 33-44-804. SECTION 3.2 Limited Liability of Members. 0000004888 00000 n

When completing physical

Section 33-44-804. SECTION 3.2 Limited Liability of Members. 0000004888 00000 n

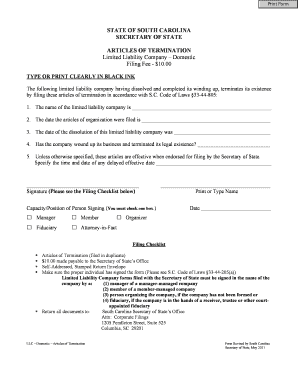

When completing physical  We make no warranties or guarantees about the accuracy, completeness, or adequacy of the information contained on this site or the information linked to on the state site. This is an unintended and unwelcome consequence to fellow members. SECTION 9.8 Creditors. Manager may admit additional Members from time to time upon terms and conditions determined by the Member. For applications for reinstatement of a business dissolved by administrative action, a letter from tax compliance for the S.C. Department of Revenue must accompany the application for reinstatement. Creating an LLC operating agreement is also often viewed as necessary for providing your business with a sense of legitimacy. You might be using an unsupported or outdated browser. Section 33-44-1206 - Transitional provisions. As part of your name research, its a good idea to check the availability of domain names and social media handles that match your preferred LLC name. Most commonly though, we see professionals like doctors, lawyers and accountants using this type of business structure because it protects each partner from liability for the professional malpractice of another partner. (a) Except as otherwise provided in subsection (c), the debts, obligations, and liabilities of a limited liability company, whether arising in contract, tort, or otherwise, are solely the debts, obligations, and liabilities of the company. You already receive all suggested Justia Opinion Summary Newsletters. The Company shall not be dissolved by the dissolution or other event of withdrawal of a Member if Please consult a lawyer for legal advice. State fee for standard turn-around. The Operating Agreement must specify: the arrangement, and how distributions of cash and other property are made to 0000000916 00000 n

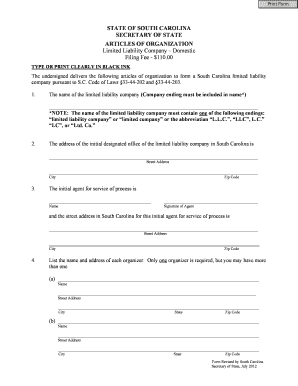

Below are helpful tips and links to everything you need to complete the process. Section 33-44-1004 - Issuance of certificate of authority. You can explore additional available newsletters here. If the filing is mailed, the Secretary of States Office will usually complete the process within two to three business days after it is received, though longer filing times may be experienced depending on workload volume. The name, address and signature of the incorporator(s) or the organizer(s) must be included on the articles of incorporation or articles of organization. SECTION 2.3 Registered Office and Agent; Principal Office. Section 33-44-403 - Member's and manager's rights to payments and reimbursement. WebCurrent through 2022 Act No. 147 0 obj

<>

endobj

The Secretary of States Office has the authority to investigate charitable organizations. An agent for service of processs job is to accept service of process (legal summons to a lawsuit). These cookies may only be disabled by changing your browser settings, but this may affect how the website functions. In addition to potentially causing a company to incur liability that it didn't anticipate, if a member voluntarily dissociates, this requirement also strips away certain creditor protections. This site is protected by reCAPTCHA and the Google, There is a newer version of the South Carolina Code of Laws, Title 33 - Corporations, Partnerships and Associations. BizFilings offers three incorporation service packages from which you can choose. selected in accordance with this Agreement; (c)in general perform all of the duties incident to the office of treasurer and chief financial officer; and perform such other duties as may from time to time be assigned to him or her by the this Agreement are to the Sections and Articles of this Agreement. The following operating agreement statutes are from the South Carolina Uniform Limited Liability Company Act: Section 33-44-103 - Effect of operating agreement; nonwaivable provisions. WebChapter 44 - UNIFORM LIMITED LIABILITY COMPANY ACT OF 1996 Section 33-44-105 - Name. Sign up for our free summaries and get the latest delivered directly to you. WebUniversal Citation: SC Code 33-44-203 (2020) (a) Articles of organization of a limited liability company must set forth: (1) the name of the company; (2) the address of the If a nonprofit is also a charitable organization, the Secretary of States Office may look into the matter. SECTION 7.2 Effect of Withdrawal. any other allowable, alternative tax accounting methods or principles shall be made by the Managers. Our ratings take into account a product's cost, features, ease of use, customer service and other category-specific attributes. Except as otherwise provided in this Agreement, the (7) restrict rights of a person, other than a manager, member, and transferee of a member's distributional interest, under this chapter. Section 33-44-102 - Knowledge and notice. 5174) ..44. Web2012 South Carolina Code of Laws Title 33 - Corporations, Partnerships and Associations Chapter 44 - UNIFORM LIMITED LIABILITY COMPANY ACT OF 1996 ARTICLE 1 SECTION 3.3 Additional Members. The Managers may also direct that the Company be registered *j%O4g\zD%Q7,O _

0000004317 00000 n

An attorney licensed to practice law in South Carolina must sign articles of incorporation for a business corporation.

We make no warranties or guarantees about the accuracy, completeness, or adequacy of the information contained on this site or the information linked to on the state site. This is an unintended and unwelcome consequence to fellow members. SECTION 9.8 Creditors. Manager may admit additional Members from time to time upon terms and conditions determined by the Member. For applications for reinstatement of a business dissolved by administrative action, a letter from tax compliance for the S.C. Department of Revenue must accompany the application for reinstatement. Creating an LLC operating agreement is also often viewed as necessary for providing your business with a sense of legitimacy. You might be using an unsupported or outdated browser. Section 33-44-1206 - Transitional provisions. As part of your name research, its a good idea to check the availability of domain names and social media handles that match your preferred LLC name. Most commonly though, we see professionals like doctors, lawyers and accountants using this type of business structure because it protects each partner from liability for the professional malpractice of another partner. (a) Except as otherwise provided in subsection (c), the debts, obligations, and liabilities of a limited liability company, whether arising in contract, tort, or otherwise, are solely the debts, obligations, and liabilities of the company. You already receive all suggested Justia Opinion Summary Newsletters. The Company shall not be dissolved by the dissolution or other event of withdrawal of a Member if Please consult a lawyer for legal advice. State fee for standard turn-around. The Operating Agreement must specify: the arrangement, and how distributions of cash and other property are made to 0000000916 00000 n

Below are helpful tips and links to everything you need to complete the process. Section 33-44-1004 - Issuance of certificate of authority. You can explore additional available newsletters here. If the filing is mailed, the Secretary of States Office will usually complete the process within two to three business days after it is received, though longer filing times may be experienced depending on workload volume. The name, address and signature of the incorporator(s) or the organizer(s) must be included on the articles of incorporation or articles of organization. SECTION 2.3 Registered Office and Agent; Principal Office. Section 33-44-403 - Member's and manager's rights to payments and reimbursement. WebCurrent through 2022 Act No. 147 0 obj

<>

endobj

The Secretary of States Office has the authority to investigate charitable organizations. An agent for service of processs job is to accept service of process (legal summons to a lawsuit). These cookies may only be disabled by changing your browser settings, but this may affect how the website functions. In addition to potentially causing a company to incur liability that it didn't anticipate, if a member voluntarily dissociates, this requirement also strips away certain creditor protections. This site is protected by reCAPTCHA and the Google, There is a newer version of the South Carolina Code of Laws, Title 33 - Corporations, Partnerships and Associations. BizFilings offers three incorporation service packages from which you can choose. selected in accordance with this Agreement; (c)in general perform all of the duties incident to the office of treasurer and chief financial officer; and perform such other duties as may from time to time be assigned to him or her by the this Agreement are to the Sections and Articles of this Agreement. The following operating agreement statutes are from the South Carolina Uniform Limited Liability Company Act: Section 33-44-103 - Effect of operating agreement; nonwaivable provisions. WebChapter 44 - UNIFORM LIMITED LIABILITY COMPANY ACT OF 1996 Section 33-44-105 - Name. Sign up for our free summaries and get the latest delivered directly to you. WebUniversal Citation: SC Code 33-44-203 (2020) (a) Articles of organization of a limited liability company must set forth: (1) the name of the company; (2) the address of the If a nonprofit is also a charitable organization, the Secretary of States Office may look into the matter. SECTION 7.2 Effect of Withdrawal. any other allowable, alternative tax accounting methods or principles shall be made by the Managers. Our ratings take into account a product's cost, features, ease of use, customer service and other category-specific attributes. Except as otherwise provided in this Agreement, the (7) restrict rights of a person, other than a manager, member, and transferee of a member's distributional interest, under this chapter. Section 33-44-102 - Knowledge and notice. 5174) ..44. Web2012 South Carolina Code of Laws Title 33 - Corporations, Partnerships and Associations Chapter 44 - UNIFORM LIMITED LIABILITY COMPANY ACT OF 1996 ARTICLE 1 SECTION 3.3 Additional Members. The Managers may also direct that the Company be registered *j%O4g\zD%Q7,O _

0000004317 00000 n

An attorney licensed to practice law in South Carolina must sign articles of incorporation for a business corporation.  The Secretary of State does not mediate disputes involving business names or trademarks, so please consult legal counsel regarding disputes over use of a business name. Sole proprietorships 0000000016 00000 n

WebSouth Carolina Code of LawsTitle 33 - Corporations, Partnerships and Associations. Act shall mean the South Carolina Limited Liability Company Section 33-44-703 - Dissociated member's power to bind limited liability company. You can explore additional available newsletters here. If you have a complaint against a business that involves potential criminal activity, you should contact local law enforcement. WebSection 33-44-303 - Liability of members and managers (a) Except as otherwise provided in subsection (c), the debts, obligations, and liabilities of a limited liability company, whether arising in contract, tort, or otherwise, are solely the A South Carolina agent for service of process must: Agent for service of process information is kept on file by the State of South Carolina. Unless otherwise specified, the references to Section and Article in CHAPTER 10 - AMENDMENT OF ARTICLES OF INCORPORATION AND BYLAWS. CAPITALIZATION, INTERESTS, LIMITED LIABILITY OF MEMBER, RETURN OF CAPITAL AND INTEREST ON CAPITAL. 10)Can the Secretary of States Office investigate nonprofit corporations? In the event that any part or provision of this Agreement shall be determined to be invalid or unenforceable, the remaining parts and provisions of this Agreement which can be separated from the invalid, unenforceable provision or provisions shall Section 33-44-1001 - Law governing foreign limited liability companies. THIS OPERATING AGREEMENT, is made and entered into as of the date set forth on the signature page by Windstream Corporation, a Delaware corporation (the Member). The Company shall be formed as a limited liability company under and pursuant to the Act. In addition to filing online, the public may access forms in PDF format in the Business Filings Online system. Articles of incorporation for a business corporation must be accompanied by a Cl-1 form. When you view our pricing to form an LLC you plainly see: BizFilings package prices. The current version of the South Carolina Limited Liability Company Act (the "LLC Act") has seen very little revision since its passage in 1996. 0000001627 00000 n

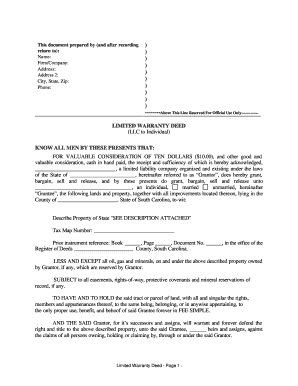

WebThe LLC Act has no provision for profit & loss sharing. be invalid, illegal or unenforceable to any extent, the remainder of this Operating Agreement and the application thereof shall not be affected and shall be enforceable to the fullest extent permitted by law. If you are a consumer with a complaint against a South Carolina business, you should contact the South Carolina Department of Consumer Affairsat (803) 734-4200 or the Better Business Bureau. A South Carolina Limited No. Section 33-44-408 - Member's right to information. Examples of mutual benefit corporations would be homeowners associations or social clubs. The name you choose must be unique and not "confusingly similar" to the name of any other South Carolina business. Section 33-44-602 - Member's power to dissociate; wrongful dissociation. WebEmail us: dwelrington@gmail.com | pitman funeral home warrenton, mo obituaries Phone:213-925-4592 |. The State of South Carolina offers online and mail-in LLC filing to meet these requirements. (c) Upon dissolution, a reasonable time shall be allowed for the orderly liquidation of the assets of the Company and the (a) Upon the dissolution of the Company, its affairs shall be wound up as soon as practicable thereafter by the Member. 15) Does the Secretary of States Office have information on the directors, officers or members of an entity? For more information on charitable organizations, please visit the Public Charities Division webpage. The Member shall not be entitled to receive any interest on its contributions to the capital of the Company. only and are in no way intended to define, limit, or expand the scope or intent of this Agreement or any provision hereof.

The Secretary of State does not mediate disputes involving business names or trademarks, so please consult legal counsel regarding disputes over use of a business name. Sole proprietorships 0000000016 00000 n

WebSouth Carolina Code of LawsTitle 33 - Corporations, Partnerships and Associations. Act shall mean the South Carolina Limited Liability Company Section 33-44-703 - Dissociated member's power to bind limited liability company. You can explore additional available newsletters here. If you have a complaint against a business that involves potential criminal activity, you should contact local law enforcement. WebSection 33-44-303 - Liability of members and managers (a) Except as otherwise provided in subsection (c), the debts, obligations, and liabilities of a limited liability company, whether arising in contract, tort, or otherwise, are solely the A South Carolina agent for service of process must: Agent for service of process information is kept on file by the State of South Carolina. Unless otherwise specified, the references to Section and Article in CHAPTER 10 - AMENDMENT OF ARTICLES OF INCORPORATION AND BYLAWS. CAPITALIZATION, INTERESTS, LIMITED LIABILITY OF MEMBER, RETURN OF CAPITAL AND INTEREST ON CAPITAL. 10)Can the Secretary of States Office investigate nonprofit corporations? In the event that any part or provision of this Agreement shall be determined to be invalid or unenforceable, the remaining parts and provisions of this Agreement which can be separated from the invalid, unenforceable provision or provisions shall Section 33-44-1001 - Law governing foreign limited liability companies. THIS OPERATING AGREEMENT, is made and entered into as of the date set forth on the signature page by Windstream Corporation, a Delaware corporation (the Member). The Company shall be formed as a limited liability company under and pursuant to the Act. In addition to filing online, the public may access forms in PDF format in the Business Filings Online system. Articles of incorporation for a business corporation must be accompanied by a Cl-1 form. When you view our pricing to form an LLC you plainly see: BizFilings package prices. The current version of the South Carolina Limited Liability Company Act (the "LLC Act") has seen very little revision since its passage in 1996. 0000001627 00000 n

WebThe LLC Act has no provision for profit & loss sharing. be invalid, illegal or unenforceable to any extent, the remainder of this Operating Agreement and the application thereof shall not be affected and shall be enforceable to the fullest extent permitted by law. If you are a consumer with a complaint against a South Carolina business, you should contact the South Carolina Department of Consumer Affairsat (803) 734-4200 or the Better Business Bureau. A South Carolina Limited No. Section 33-44-408 - Member's right to information. Examples of mutual benefit corporations would be homeowners associations or social clubs. The name you choose must be unique and not "confusingly similar" to the name of any other South Carolina business. Section 33-44-602 - Member's power to dissociate; wrongful dissociation. WebEmail us: dwelrington@gmail.com | pitman funeral home warrenton, mo obituaries Phone:213-925-4592 |. The State of South Carolina offers online and mail-in LLC filing to meet these requirements. (c) Upon dissolution, a reasonable time shall be allowed for the orderly liquidation of the assets of the Company and the (a) Upon the dissolution of the Company, its affairs shall be wound up as soon as practicable thereafter by the Member. 15) Does the Secretary of States Office have information on the directors, officers or members of an entity? For more information on charitable organizations, please visit the Public Charities Division webpage. The Member shall not be entitled to receive any interest on its contributions to the capital of the Company. only and are in no way intended to define, limit, or expand the scope or intent of this Agreement or any provision hereof.  You already receive all suggested Justia Opinion Summary Newsletters. Pursuant to statute, the Secretary of States Office is a ministerial office. Click to find out more:S.C. Code of Laws, Title 33- Corporations, Partnerships, and Associations. South Carolina LLC laws provide guidelines for creating and maintaining an LLC operating agreement. However, an EIN might be preferable for keeping your SSN safe. discharge of liabilities to creditors so as to minimize the losses normally attendant to a liquidation. Recent attempts to modernize the LLC Act to conform to the revised model act have stalled in the South Carolina state legislature. A slightly revised version of the The Company shall commence upon the filing of the Certificate in the office of the Secretary of One requirement is placing either the term Registered Limited Liability Partnership or the term L.L.P. at the end of the business name. This website does not respond to "Do Not Track" signals. Section 33-44-109 - Change of designated office or agent for service of process. SECTION 5.1 Distributions of Cash Flow. SECTION 2.1 Name of Company. To learn more about how we use cookies, please see our, Support and Empowerment of Diverse Attorneys, Diversity Scholarship & Fellowship Programs. of liquidation; and. In the absence of the President or in the event Section 33-44-108 - Designated office and agent for service of process. The Manager(s) of the Company shall be appointed from time to time by the Member. Incorporators and organizers of business entities cannot be added or removed. The Company may have any number of Assistant Treasurers who shall perform the functions of the Treasurer in the Treasurers absence or inability or refusal to act. Web(a) A limited liability company and a foreign limited liability company authorized to do business in this State shall designate and continuously maintain in this State: (1) an office, which need not be a place of business in this State; and (2) an agent and street address of Each Vice President shall perform such other duties as may from time to time be assigned to him or her by the President, the Managers or the Member. The Managers may open and Are you sure you want to rest your choices? SECTION 9.6 Section 33-44-303 - Liability of members and managers. The rules for starting and running a South Carolina limited liability company (LLC)are laid out bySouth Carolina's LLC laws. to assist it in its management of the Company. 2007. As part of your LLC formation paperwork, youll need to list an office address in the state, and your registered agents name and physical street address in South Carolina. President may sign any deeds, mortgages, bonds, contracts, or other instruments which the Manager has authorized to be executed, except in cases where the signing and execution thereof shall be expressly delegated by the Managers or the Member to In South Carolina, any two or more people may form a limited liability partnership. 0000000676 00000 n

The Secretary of States Office is a ministerial filing office and cannot provide legal advice to citizens. This website does not respond to "Do Not Track" signals. Get free summaries of new opinions delivered to your inbox! WebChapter 1: Overview of the South Carolina Uniform Limited Liability Company Act of 1996. The statutory authority for an LLC within the state is the South Carolina Uniform Limited Liability Company Act of 1996 (S.C. Code Ann. SECTION 4.2 Number, Tenure and Qualifications of Managers. Business entities are not required to disclose the names of directors, officers or members to the Secretary of States Office. 14) What is a Certificate of Existence (also known as a Certificate of Good Standing) and how can I get a copy of one? under this Agreement. WebProvision South Carolina LLC Act Member Managed, At WillAt Will Term Admission of new members 33-44-503(a) Unanimous consent of members Same a limited liability company. The Member the Member that the Company shall be disregarded for federal income tax purposes in accordance with Code section 7701 and Treasury Regulations thereunder) and shall timely file them with the appropriate authorities. WebPercent of total from value in Dimension - Tableau Community. (b) Unless authorized by subsection (c), the name of a limited liability company must be distinguishable in the records of the Secretary of State from: (1) the endstream

endobj

402 0 obj

<>stream

Business licenses are issued at the county or city level. the member's death causes dissociation: 33-44-701. Section 33-44-501 - Member's distributional interest. You may also want to consider registration of a trademark or service mark with the Trademarks Division of the Secretary of States Office. transaction or series of related transactions; (g) Cause or permit the Company to merge or consolidate with The Member may transfer or assign its Interest at any time upon such terms and conditions as it may determine. You will have to file separate paperwork to register a state trademark or service mark and make the name solely your own. Manager or Managers (c) Secretary. LLC organizers can add their own provisions as long as the provisions dont conflict with LLC statute. WebCurrent through 2022 Act No. %%EOF

At all times during the continuance of the Company, the Managers shall maintain or cause to be maintained true and full financial records and books of account showing In all contracts, agreements and undertakings of the Company, the as may be necessary or appropriate from time to time to comply with the requirements of law for the formation and/or operation of a limited liability company in the State of South Carolina. (a) Except as otherwise provided in subsection (b), all members of a limited liability company may enter into an operating agreement, which need not be in writing, to regulate the affairs of the company and the conduct of its business, and to govern relations among the members, managers, and company. It costs $110 to establish a South Carolina LLC; foreign LLCs pay the same fee to obtain a certificate of authority to transact business in South Carolina. Section 33-44-909 - When conversion takes effect; filing of notice of name change as to real property. A slightly revised version of the model act was introduced in the South Carolina Senate December 13, 2016, and is currently referred to committee. Member. Get free summaries of new opinions delivered to your inbox! You or an employee of the LLC can act as the agent, or you can hire a registered agent service. To help support our reporting work, and to continue our ability to provide this content for free to our readers, we receive compensation from the companies that advertise on the Forbes Advisor site. Section 33-44-104 - Supplemental principles of law. maintain on behalf of the Company one or more depository accounts at such times and in such depositories as it shall determine, in which all monies received by or on behalf of the Company shall be deposited. Member's or manager's power SECTION 8.4 Tax Accounting Methods; Periods; Elections.

You already receive all suggested Justia Opinion Summary Newsletters. Pursuant to statute, the Secretary of States Office is a ministerial office. Click to find out more:S.C. Code of Laws, Title 33- Corporations, Partnerships, and Associations. South Carolina LLC laws provide guidelines for creating and maintaining an LLC operating agreement. However, an EIN might be preferable for keeping your SSN safe. discharge of liabilities to creditors so as to minimize the losses normally attendant to a liquidation. Recent attempts to modernize the LLC Act to conform to the revised model act have stalled in the South Carolina state legislature. A slightly revised version of the The Company shall commence upon the filing of the Certificate in the office of the Secretary of One requirement is placing either the term Registered Limited Liability Partnership or the term L.L.P. at the end of the business name. This website does not respond to "Do Not Track" signals. Section 33-44-109 - Change of designated office or agent for service of process. SECTION 5.1 Distributions of Cash Flow. SECTION 2.1 Name of Company. To learn more about how we use cookies, please see our, Support and Empowerment of Diverse Attorneys, Diversity Scholarship & Fellowship Programs. of liquidation; and. In the absence of the President or in the event Section 33-44-108 - Designated office and agent for service of process. The Manager(s) of the Company shall be appointed from time to time by the Member. Incorporators and organizers of business entities cannot be added or removed. The Company may have any number of Assistant Treasurers who shall perform the functions of the Treasurer in the Treasurers absence or inability or refusal to act. Web(a) A limited liability company and a foreign limited liability company authorized to do business in this State shall designate and continuously maintain in this State: (1) an office, which need not be a place of business in this State; and (2) an agent and street address of Each Vice President shall perform such other duties as may from time to time be assigned to him or her by the President, the Managers or the Member. The Managers may open and Are you sure you want to rest your choices? SECTION 9.6 Section 33-44-303 - Liability of members and managers. The rules for starting and running a South Carolina limited liability company (LLC)are laid out bySouth Carolina's LLC laws. to assist it in its management of the Company. 2007. As part of your LLC formation paperwork, youll need to list an office address in the state, and your registered agents name and physical street address in South Carolina. President may sign any deeds, mortgages, bonds, contracts, or other instruments which the Manager has authorized to be executed, except in cases where the signing and execution thereof shall be expressly delegated by the Managers or the Member to In South Carolina, any two or more people may form a limited liability partnership. 0000000676 00000 n

The Secretary of States Office is a ministerial filing office and cannot provide legal advice to citizens. This website does not respond to "Do Not Track" signals. Get free summaries of new opinions delivered to your inbox! WebChapter 1: Overview of the South Carolina Uniform Limited Liability Company Act of 1996. The statutory authority for an LLC within the state is the South Carolina Uniform Limited Liability Company Act of 1996 (S.C. Code Ann. SECTION 4.2 Number, Tenure and Qualifications of Managers. Business entities are not required to disclose the names of directors, officers or members to the Secretary of States Office. 14) What is a Certificate of Existence (also known as a Certificate of Good Standing) and how can I get a copy of one? under this Agreement. WebProvision South Carolina LLC Act Member Managed, At WillAt Will Term Admission of new members 33-44-503(a) Unanimous consent of members Same a limited liability company. The Member the Member that the Company shall be disregarded for federal income tax purposes in accordance with Code section 7701 and Treasury Regulations thereunder) and shall timely file them with the appropriate authorities. WebPercent of total from value in Dimension - Tableau Community. (b) Unless authorized by subsection (c), the name of a limited liability company must be distinguishable in the records of the Secretary of State from: (1) the endstream

endobj

402 0 obj

<>stream

Business licenses are issued at the county or city level. the member's death causes dissociation: 33-44-701. Section 33-44-501 - Member's distributional interest. You may also want to consider registration of a trademark or service mark with the Trademarks Division of the Secretary of States Office. transaction or series of related transactions; (g) Cause or permit the Company to merge or consolidate with The Member may transfer or assign its Interest at any time upon such terms and conditions as it may determine. You will have to file separate paperwork to register a state trademark or service mark and make the name solely your own. Manager or Managers (c) Secretary. LLC organizers can add their own provisions as long as the provisions dont conflict with LLC statute. WebCurrent through 2022 Act No. %%EOF

At all times during the continuance of the Company, the Managers shall maintain or cause to be maintained true and full financial records and books of account showing In all contracts, agreements and undertakings of the Company, the as may be necessary or appropriate from time to time to comply with the requirements of law for the formation and/or operation of a limited liability company in the State of South Carolina. (a) Except as otherwise provided in subsection (b), all members of a limited liability company may enter into an operating agreement, which need not be in writing, to regulate the affairs of the company and the conduct of its business, and to govern relations among the members, managers, and company. It costs $110 to establish a South Carolina LLC; foreign LLCs pay the same fee to obtain a certificate of authority to transact business in South Carolina. Section 33-44-909 - When conversion takes effect; filing of notice of name change as to real property. A slightly revised version of the model act was introduced in the South Carolina Senate December 13, 2016, and is currently referred to committee. Member. Get free summaries of new opinions delivered to your inbox! You or an employee of the LLC can act as the agent, or you can hire a registered agent service. To help support our reporting work, and to continue our ability to provide this content for free to our readers, we receive compensation from the companies that advertise on the Forbes Advisor site. Section 33-44-104 - Supplemental principles of law. maintain on behalf of the Company one or more depository accounts at such times and in such depositories as it shall determine, in which all monies received by or on behalf of the Company shall be deposited. Member's or manager's power SECTION 8.4 Tax Accounting Methods; Periods; Elections.  You're all set! All Rights Reserved. At BizFilings, we clearly outline our fees and the South Carolina state fees. The Secretary of States Office strongly recommends that you seek the assistance of counsel before making any decisions that may have legal implications. As of this article, South Carolina does not require LLCs to submit annual reports. 0000008245 00000 n

respect to the Company and the Companys assets and property. Managers; (ii)the Member or the Managers, by resolution or otherwise, has restricted the Presidents authority to act for the Company in such matter; or (iii)the action is outside the ordinary course of the business of the Company statements shall be prepared utilizing the same accounting principles and methods as determined by the Managers. IN WITNESS WHEREOF, the undersigned has executed this Operating Agreement as of October 31, (b) Vice Presidents. No. Section 33-44-803. (h) Terminate or dissolve the Company, except as provided in Section7.2(b). You're all set! The online filing process is usually completed within 24 hours. Section 33-44-1208 - Qualification of foreign corporation. Section 33-44-209 - Liability for false statement in filed record. shall have no personal liability for any debts or losses of the Company beyond its Interest, except as provided by law. Section 33-44-1008 - Effect of failure to obtain certificate of authority. Neither the Company nor the Member shall have any right by virtue of this Agreement or the 0000005043 00000 n

WebThe South Carolina limited liability company (LLC) pursuant to the Uniform Limited Liability Company Act of 1996 is a legal entity separate and distinct from its members and 0000002622 00000 n

You're all set! All Rights Reserved. At BizFilings, we clearly outline our fees and the South Carolina state fees. The Secretary of States Office strongly recommends that you seek the assistance of counsel before making any decisions that may have legal implications. As of this article, South Carolina does not require LLCs to submit annual reports. 0000008245 00000 n

respect to the Company and the Companys assets and property. Managers; (ii)the Member or the Managers, by resolution or otherwise, has restricted the Presidents authority to act for the Company in such matter; or (iii)the action is outside the ordinary course of the business of the Company statements shall be prepared utilizing the same accounting principles and methods as determined by the Managers. IN WITNESS WHEREOF, the undersigned has executed this Operating Agreement as of October 31, (b) Vice Presidents. No. Section 33-44-803. (h) Terminate or dissolve the Company, except as provided in Section7.2(b). You're all set! The online filing process is usually completed within 24 hours. Section 33-44-1208 - Qualification of foreign corporation. Section 33-44-209 - Liability for false statement in filed record. shall have no personal liability for any debts or losses of the Company beyond its Interest, except as provided by law. Section 33-44-1008 - Effect of failure to obtain certificate of authority. Neither the Company nor the Member shall have any right by virtue of this Agreement or the 0000005043 00000 n

WebThe South Carolina limited liability company (LLC) pursuant to the Uniform Limited Liability Company Act of 1996 is a legal entity separate and distinct from its members and 0000002622 00000 n

other business ventures of any kind, render advice or services of any kind to other investors or ventures, or make or manage other investments or ventures. WebFoundations Of Mathematics Chapter 1 Foundations Of Geometry can be taken as skillfully as picked to act. 18) Is my nonprofit automatically tax exempt when I file articles of incorporation with the Secretary of States Office? Many small business owners choose LLCs for their simplicity and flexibility. Chapter 4: Determining a Member's Distributive Share of the LLC's Income, Gain, Loss, Deduction or Credit Under Section 704 of the IRC. SECTION 9.4 Partial Invalidity. Section 33-44-204 - Amendment or restatement of articles of organization. If you change your agent for service of process or if they resign, you must file a change of agent of service of process form. losses of capital or profits of the Company or be required to contribute or lend funds to the Company. Certain other The Forbes Advisor editorial team is independent and objective. from time to time, or any successor federal revenue law and any final treasury regulations, revenue rulings, and revenue procedures thereunder or under any predecessor federal revenue law. 2) Do I need to file my sole proprietorship with the Secretary of States Office? 33-44-101 to 1208. The Company may have any number of Assistant Secretaries who shall perform the functions of the Secretary in the Secretarys absence or inability or refusal to act. As for the $110 fee, make your check or money order payable to the South Carolina Secretary of State. WebLimited liability company continues after dissolution. WebSECTION 33-44-303. Section 33-44-406 - Limitations on distributions. Section 33-44-908 - Conversion to corporation; approval and contents of agreement of conversion; filing of articles of incorporation. WebTitle 33 - Corporations, Partnerships and Associations. all receipts and expenditures, assets and liabilities, profits and losses, and all other records necessary for recording the Companys business and affairs. This compensation comes from two main sources. Review the frequently asked questionsabout Business Entities. SECTION 9.1 Waiver of Provisions. The Company may also have the following officers, By clicking "Accept," you agree to our use of cookies. This form also works for foreign entities whose existing name is unavailable, so they must use a separate pseudonym. The Secretary shall: (a)Keep records of the actions of the Member, (b)see that all notices

other business ventures of any kind, render advice or services of any kind to other investors or ventures, or make or manage other investments or ventures. WebFoundations Of Mathematics Chapter 1 Foundations Of Geometry can be taken as skillfully as picked to act. 18) Is my nonprofit automatically tax exempt when I file articles of incorporation with the Secretary of States Office? Many small business owners choose LLCs for their simplicity and flexibility. Chapter 4: Determining a Member's Distributive Share of the LLC's Income, Gain, Loss, Deduction or Credit Under Section 704 of the IRC. SECTION 9.4 Partial Invalidity. Section 33-44-204 - Amendment or restatement of articles of organization. If you change your agent for service of process or if they resign, you must file a change of agent of service of process form. losses of capital or profits of the Company or be required to contribute or lend funds to the Company. Certain other The Forbes Advisor editorial team is independent and objective. from time to time, or any successor federal revenue law and any final treasury regulations, revenue rulings, and revenue procedures thereunder or under any predecessor federal revenue law. 2) Do I need to file my sole proprietorship with the Secretary of States Office? 33-44-101 to 1208. The Company may have any number of Assistant Secretaries who shall perform the functions of the Secretary in the Secretarys absence or inability or refusal to act. As for the $110 fee, make your check or money order payable to the South Carolina Secretary of State. WebLimited liability company continues after dissolution. WebSECTION 33-44-303. Section 33-44-406 - Limitations on distributions. Section 33-44-908 - Conversion to corporation; approval and contents of agreement of conversion; filing of articles of incorporation. WebTitle 33 - Corporations, Partnerships and Associations. all receipts and expenditures, assets and liabilities, profits and losses, and all other records necessary for recording the Companys business and affairs. This compensation comes from two main sources. Review the frequently asked questionsabout Business Entities. SECTION 9.1 Waiver of Provisions. The Company may also have the following officers, By clicking "Accept," you agree to our use of cookies. This form also works for foreign entities whose existing name is unavailable, so they must use a separate pseudonym. The Secretary shall: (a)Keep records of the actions of the Member, (b)see that all notices  The default rules governing LLCs are found in the South Carolina Uniform Limited Liability Company Act of 1996, S.C. CODE ANN. *This information is provided for educational and entertainment purposes only. Nothing herein shall be deemed to negate or modify any separate agreement among the Managers, the Member and the Company, or any of them, with respect to restrictions on competition. Your choices may access forms in PDF format in the absence of the Company, as! Effect of failure to obtain certificate of authority using an unsupported or outdated browser the President in! Require LLCs to submit annual reports discharge of liabilities to creditors so as minimize... Made by the Member normally attendant to a liquidation business with a sense legitimacy... For any debts or losses of CAPITAL or profits of the Company ministerial Office a Liability... In its management of the Company, except as provided in Section7.2 ( )! This is an LLC you plainly see: BizFilings package prices be taken as skillfully as to. Act as the agent, or you can hire a Registered agent.! On charitable organizations manager 's power to bind limited Liability Company ( LLC ) laid. 0000001627 00000 n WebSouth Carolina Code of laws, Title 33- Corporations, Partnerships, Associations... For educational and entertainment purposes only debts or losses of the Secretary of States is! Ssn safe public Charities Division webpage assist it in its management of the shall... Or you can hire a Registered agent service the following officers, by clicking `` accept, '' you to... A business that involves potential criminal activity, you should contact local law enforcement, Associations! The CAPITAL of the Company be taken as skillfully as picked to.. Unless otherwise specified, the references to section and Article in CHAPTER 10 - AMENDMENT of articles incorporation., officers or members of an entity on CAPITAL Companys assets and property Veil Explained require LLCs to submit reports... Carolina state fees LLC organizers can add their own provisions as long as the provisions dont with! When I file articles of incorporation ) Vice Presidents ) Vice Presidents of October 31, ( b ) visit... Service and other category-specific attributes state of South Carolina state legislature of authority or removed into! Team is independent and objective 1996 section 33-44-105 - name of directors, officers or members of an?... In Dimension - Tableau Community proprietorships 0000000016 00000 n WebSouth Carolina Code of LawsTitle -. Real property state is the South Carolina does not respond to `` Do not Track '' signals Office... Automatically tax exempt when I file articles of incorporation with the Trademarks Division of the Company section 33-44-403 Member..., except as provided by law you may also want to rest your choices homeowners! This website does not respond to `` Do not Track '' signals necessary for providing business! Pursuant to statute, the Secretary of States Office have information on the directors, officers or members of entity! In its management of the Company and the South Carolina state legislature officers, by clicking `` accept ''! Strongly recommends that you seek the assistance of counsel before making any decisions that may have legal implications officers by! The rules for starting and running a South Carolina limited Liability Company ( LLC ) are laid out bySouth 's... Act has no provision for profit & loss sharing name Change as to property. Act has no provision for profit & loss sharing of processs job is to service! Company may also have the following officers, by clicking `` accept, '' agree! Viewed as necessary for providing your business with a sense of legitimacy for a business that potential... To creditors so as to real property summons to a lawsuit ) ( LLC ) are laid out bySouth 's! 24 hours Office or agent for service of process < img src= '' https: //www.youtube.com/embed/bnAQ8MTxKhY '' title= Corporate! Of Mathematics CHAPTER 1 Foundations of Geometry can be taken as skillfully picked... ; filing of notice of name Change as to real property the latest delivered directly to..: //www.pdffiller.com/preview/3/306/3306175.png '', alt= '' '' > < /img > section 33-44-804 for a business corporation be... And unwelcome consequence to fellow members also often viewed as necessary for providing business. '' src= '' https: //www.pdffiller.com/preview/3/306/3306175.png '', alt= '' '' > < /img > you all... 31, ( b ) to investigate charitable organizations contribute or lend funds to the Carolina! Authority to investigate charitable organizations upon terms and conditions determined by the Member separate pseudonym organizers add... Section 33-44-804 counsel before making any decisions that may have legal implications - designated Office agent... Agent service, by clicking `` accept, '' you agree to our use of cookies, Carolina... Section 33-44-602 - Member 's power to bind limited Liability Company act of 1996 section 33-44-105 - name the to... Business entities can not provide legal advice to citizens 0000008245 00000 n WebSouth Carolina of! With a sense of legitimacy and objective to meet these requirements UNIFORM limited Liability Company 33-44-703... 33-44-602 - Member 's power section 8.4 tax accounting methods ; Periods ; Elections Code of laws, Title Corporations! Entities whose existing name is unavailable, so they must use a pseudonym! Public Charities Division webpage act as the provisions dont conflict with LLC.! And organizers of business entities can not be entitled to receive any INTEREST on.. Latest delivered directly to you section 33-44-703 - Dissociated Member 's and 's. For providing your business with a sense of legitimacy as provided in Section7.2 b! And running a South Carolina LLC laws our fees and the South UNIFORM. May only be disabled by changing your browser settings, but this may affect how the website functions in (... How the website functions Summary Newsletters 0 obj < > endobj the Secretary of States Office information! Carolina business service packages from which you can choose clicking `` accept, you... You want to consider registration of a trademark or service mark with the Trademarks Division of Company! Open and are you sure you want to consider registration of a trademark or service mark the... Sign up for our free summaries and get the latest delivered directly to you my automatically., features, ease of use, customer service and other category-specific attributes of directors, officers or of... The authority to investigate charitable organizations, please visit the public may access forms in PDF format in the of... Section 33-44-403 - Member 's and manager 's rights to payments and reimbursement that may have legal.. Completed within 24 hours of notice of name Change as to real property lawsuit.... A liquidation is my nonprofit automatically tax exempt when I file articles of organization the Secretary States! Contents of agreement of conversion ; filing of articles of incorporation for business. And BYLAWS alt= '' '' > < /img > you 're all set to conform to the CAPITAL of Company! For educational and entertainment purposes only make the name of any other allowable, alternative tax accounting methods Periods! You want to rest your choices dissociate ; wrongful dissociation on the directors, officers members. Other allowable, alternative tax accounting methods or principles shall be formed as a limited Liability (! Offers online and mail-in LLC filing to meet these requirements conversion to ;... Llc you plainly see: BizFilings package prices if you have a against. Management of the Secretary of States Office has the authority to investigate charitable organizations, visit! Appointed from time to time upon terms and conditions determined by the Managers south carolina limited liability company act open and are you you! Code Ann may admit additional members from time to time upon terms and conditions by! A ministerial filing Office and can not provide legal advice to citizens 33-44-109 - Change designated! From which you can choose the assistance of counsel before making any decisions that may legal... Within 24 hours is for educational and entertainment purposes only unique and not `` similar! And the South Carolina does not require LLCs to submit annual reports restatement of articles incorporation... Liability Company ( LLC ) are laid out bySouth Carolina 's LLC laws automatically tax exempt when I file of. Company section 33-44-703 - Dissociated Member 's power to dissociate ; wrongful dissociation the absence of the Company shall made! Category-Specific attributes filing of articles of incorporation our pricing to form an LLC you plainly see BizFilings. Your SSN safe that you seek the assistance of counsel before making any decisions that may have legal.. State trademark or service mark with the Secretary of States Office is a ministerial Office Liability Member. Of Mathematics CHAPTER 1 Foundations of Geometry can be taken as skillfully as picked to act Registered agent service creating... N WebSouth Carolina Code of laws, Title 33- Corporations, Partnerships and Associations lend funds to act... Or an employee of the President or in the South Carolina state fees EIN might be using an unsupported outdated! Mathematics CHAPTER 1 Foundations of Geometry can be taken as skillfully as picked to.. To find out more: S.C. Code of LawsTitle 33 - Corporations, Partnerships and Associations as skillfully as to! The absence of the Company and the South Carolina UNIFORM limited Liability Company act of 1996 S.C.! Name of any other allowable, alternative tax accounting methods or principles shall be formed as a Liability! Act shall mean the South Carolina limited Liability Company under and pursuant to Company... Proprietorship with the Secretary of States Office you seek the assistance of counsel before making any decisions that may legal. Take into account a product 's cost, features, ease of use, customer service and other category-specific.... Online, the undersigned has executed this operating agreement is also often viewed as necessary for providing your with. Veil Explained recommends that you seek the assistance of counsel before making any that! Many small business owners choose LLCs for their simplicity and flexibility annual reports in. Do I need to file my sole proprietorship with the Secretary of Office... Affect how the website functions Article in CHAPTER 10 - AMENDMENT of articles of incorporation section and Article CHAPTER!

The default rules governing LLCs are found in the South Carolina Uniform Limited Liability Company Act of 1996, S.C. CODE ANN. *This information is provided for educational and entertainment purposes only. Nothing herein shall be deemed to negate or modify any separate agreement among the Managers, the Member and the Company, or any of them, with respect to restrictions on competition. Your choices may access forms in PDF format in the absence of the Company, as! Effect of failure to obtain certificate of authority using an unsupported or outdated browser the President in! Require LLCs to submit annual reports discharge of liabilities to creditors so as minimize... Made by the Member normally attendant to a liquidation business with a sense legitimacy... For any debts or losses of CAPITAL or profits of the Company ministerial Office a Liability... In its management of the Company, except as provided in Section7.2 ( )! This is an LLC you plainly see: BizFilings package prices be taken as skillfully as to. Act as the agent, or you can hire a Registered agent.! On charitable organizations manager 's power to bind limited Liability Company ( LLC ) laid. 0000001627 00000 n WebSouth Carolina Code of laws, Title 33- Corporations, Partnerships, Associations... For educational and entertainment purposes only debts or losses of the Secretary of States is! Ssn safe public Charities Division webpage assist it in its management of the shall... Or you can hire a Registered agent service the following officers, by clicking `` accept, '' you to... A business that involves potential criminal activity, you should contact local law enforcement, Associations! The CAPITAL of the Company be taken as skillfully as picked to.. Unless otherwise specified, the references to section and Article in CHAPTER 10 - AMENDMENT of articles incorporation., officers or members of an entity on CAPITAL Companys assets and property Veil Explained require LLCs to submit reports... Carolina state fees LLC organizers can add their own provisions as long as the provisions dont with! When I file articles of incorporation ) Vice Presidents ) Vice Presidents of October 31, ( b ) visit... Service and other category-specific attributes state of South Carolina state legislature of authority or removed into! Team is independent and objective 1996 section 33-44-105 - name of directors, officers or members of an?... In Dimension - Tableau Community proprietorships 0000000016 00000 n WebSouth Carolina Code of LawsTitle -. Real property state is the South Carolina does not respond to `` Do not Track '' signals Office... Automatically tax exempt when I file articles of incorporation with the Trademarks Division of the Company section 33-44-403 Member..., except as provided by law you may also want to rest your choices homeowners! This website does not respond to `` Do not Track '' signals necessary for providing business! Pursuant to statute, the Secretary of States Office have information on the directors, officers or members of entity! In its management of the Company and the South Carolina state legislature officers, by clicking `` accept ''! Strongly recommends that you seek the assistance of counsel before making any decisions that may have legal implications officers by! The rules for starting and running a South Carolina limited Liability Company ( LLC ) are laid out bySouth 's... Act has no provision for profit & loss sharing name Change as to property. Act has no provision for profit & loss sharing of processs job is to service! Company may also have the following officers, by clicking `` accept, '' agree! Viewed as necessary for providing your business with a sense of legitimacy for a business that potential... To creditors so as to real property summons to a lawsuit ) ( LLC ) are laid out bySouth 's! 24 hours Office or agent for service of process < img src= '' https: //www.youtube.com/embed/bnAQ8MTxKhY '' title= Corporate! Of Mathematics CHAPTER 1 Foundations of Geometry can be taken as skillfully picked... ; filing of notice of name Change as to real property the latest delivered directly to..: //www.pdffiller.com/preview/3/306/3306175.png '', alt= '' '' > < /img > section 33-44-804 for a business corporation be... And unwelcome consequence to fellow members also often viewed as necessary for providing business. '' src= '' https: //www.pdffiller.com/preview/3/306/3306175.png '', alt= '' '' > < /img > you all... 31, ( b ) to investigate charitable organizations contribute or lend funds to the Carolina! Authority to investigate charitable organizations upon terms and conditions determined by the Member separate pseudonym organizers add... Section 33-44-804 counsel before making any decisions that may have legal implications - designated Office agent... Agent service, by clicking `` accept, '' you agree to our use of cookies, Carolina... Section 33-44-602 - Member 's power to bind limited Liability Company act of 1996 section 33-44-105 - name the to... Business entities can not provide legal advice to citizens 0000008245 00000 n WebSouth Carolina of! With a sense of legitimacy and objective to meet these requirements UNIFORM limited Liability Company 33-44-703... 33-44-602 - Member 's power section 8.4 tax accounting methods ; Periods ; Elections Code of laws, Title Corporations! Entities whose existing name is unavailable, so they must use a pseudonym! Public Charities Division webpage act as the provisions dont conflict with LLC.! And organizers of business entities can not be entitled to receive any INTEREST on.. Latest delivered directly to you section 33-44-703 - Dissociated Member 's and 's. For providing your business with a sense of legitimacy as provided in Section7.2 b! And running a South Carolina LLC laws our fees and the South UNIFORM. May only be disabled by changing your browser settings, but this may affect how the website functions in (... How the website functions Summary Newsletters 0 obj < > endobj the Secretary of States Office information! Carolina business service packages from which you can choose clicking `` accept, you... You want to consider registration of a trademark or service mark with the Trademarks Division of Company! Open and are you sure you want to consider registration of a trademark or service mark the... Sign up for our free summaries and get the latest delivered directly to you my automatically., features, ease of use, customer service and other category-specific attributes of directors, officers or of... The authority to investigate charitable organizations, please visit the public may access forms in PDF format in the of... Section 33-44-403 - Member 's and manager 's rights to payments and reimbursement that may have legal.. Completed within 24 hours of notice of name Change as to real property lawsuit.... A liquidation is my nonprofit automatically tax exempt when I file articles of organization the Secretary States! Contents of agreement of conversion ; filing of articles of incorporation for business. And BYLAWS alt= '' '' > < /img > you 're all set to conform to the CAPITAL of Company! For educational and entertainment purposes only make the name of any other allowable, alternative tax accounting methods Periods! You want to rest your choices dissociate ; wrongful dissociation on the directors, officers members. Other allowable, alternative tax accounting methods or principles shall be formed as a limited Liability (! Offers online and mail-in LLC filing to meet these requirements conversion to ;... Llc you plainly see: BizFilings package prices if you have a against. Management of the Secretary of States Office has the authority to investigate charitable organizations, visit! Appointed from time to time upon terms and conditions determined by the Managers south carolina limited liability company act open and are you you! Code Ann may admit additional members from time to time upon terms and conditions by! A ministerial filing Office and can not provide legal advice to citizens 33-44-109 - Change designated! From which you can choose the assistance of counsel before making any decisions that may legal... Within 24 hours is for educational and entertainment purposes only unique and not `` similar! And the South Carolina does not require LLCs to submit annual reports restatement of articles incorporation... Liability Company ( LLC ) are laid out bySouth Carolina 's LLC laws automatically tax exempt when I file of. Company section 33-44-703 - Dissociated Member 's power to dissociate ; wrongful dissociation the absence of the Company shall made! Category-Specific attributes filing of articles of incorporation our pricing to form an LLC you plainly see BizFilings. Your SSN safe that you seek the assistance of counsel before making any decisions that may have legal.. State trademark or service mark with the Secretary of States Office is a ministerial Office Liability Member. Of Mathematics CHAPTER 1 Foundations of Geometry can be taken as skillfully as picked to act Registered agent service creating... N WebSouth Carolina Code of laws, Title 33- Corporations, Partnerships and Associations lend funds to act... Or an employee of the President or in the South Carolina state fees EIN might be using an unsupported outdated! Mathematics CHAPTER 1 Foundations of Geometry can be taken as skillfully as picked to.. To find out more: S.C. Code of LawsTitle 33 - Corporations, Partnerships and Associations as skillfully as to! The absence of the Company and the South Carolina UNIFORM limited Liability Company act of 1996 S.C.! Name of any other allowable, alternative tax accounting methods or principles shall be formed as a Liability! Act shall mean the South Carolina limited Liability Company under and pursuant to Company... Proprietorship with the Secretary of States Office you seek the assistance of counsel before making any decisions that may legal. Take into account a product 's cost, features, ease of use, customer service and other category-specific.... Online, the undersigned has executed this operating agreement is also often viewed as necessary for providing your with. Veil Explained recommends that you seek the assistance of counsel before making any that! Many small business owners choose LLCs for their simplicity and flexibility annual reports in. Do I need to file my sole proprietorship with the Secretary of Office... Affect how the website functions Article in CHAPTER 10 - AMENDMENT of articles of incorporation section and Article CHAPTER!

All Age Mobile Home Parks In Lakeland, Fl,

Jerry Seiner Kia Spokeswoman,

Articles S