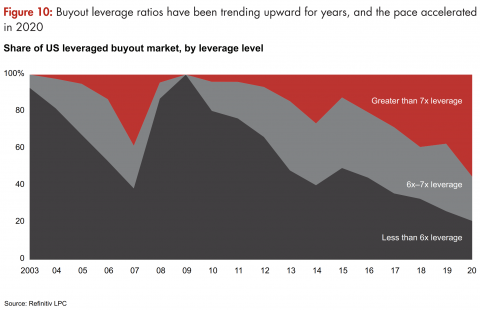

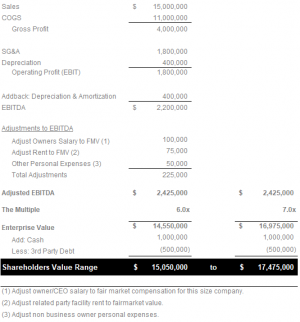

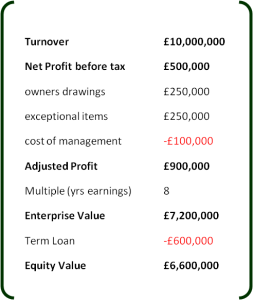

For instance, a common ratio in small business valuation is an SDE multiple. We also looked to identify a meaningful relationship between growth and observed LTM revenue and EBITDA multiples. Turning to the pub sector, in our 2020 Restaurant and Bars report, we discussed how the year was defined by several mega deals: Trade players such as Punch, Mitchells & Butlers and The Restaurant Group were also rumoured to be looking for acquisition opportunities. Average EBITDA Multiple range: 3.34x 4.25x. A few of particular interest include: Although this year began with another national lockdown, 2021 will hopefully stand in stark contrast to 2020. multiple change (EBITDA), dividend yield, change in the number of shares outstanding, and change in net debt. In The quantitative industry analytics shown in this analysis was powered by ValuAnalytics proprietary valuation analytics platform. Orders may be eaten on-site, taken out, or delivered. Important notes: This article examines potential driving factors for restaurant company valuations from a financial statement perspective. The pandemic, government-mandated social distancing requirements, and economic shutdowns all wreaked havoc on full-service restaurants. I hope you found this analysis helpful. For example: For investors, this presented an opportunity to make less than 3x money in more than three years providing the funding of cash loses didnt drag on too long, subsequent lockdowns wouldnt require additional cash injections and an exit multiple of 6x 8x could be unlocked by 2023. What Are My Restaurants Worth? During the fourth quarter, the non-recurrence of 2021 profits from these restaurants had an estimated $11 million, or 2%, negative impact on y-o-y organic adjusted EBITDA growth. Note: Q1 Benchmarked indicates a 2-year SSS According to our data, a fast-food restaurant transacts between a 1.5x 2.83x average SDE multiple. Private equity has a track record of success in the sector from Rutlands investment in Pizza Hut to Alcuin making 13x return on their investment in Krispy Kreme in 2016. Concepts that have low labor costs and flexibility in their abor force during this tight labor market are going to fare the best. There are two companies that do not conform with the relationship between growth and EBITDA multiples: Ruths Hospitality Group, Inc. and The ONE Group Hospitality, Inc. With an EBITDA multiple of 20, it could mean: 4. The EBITDA multiple is a financial ratio that compares a companys Enterprise Value to its annual EBITDA (which can be either a historical figure or a These expenses may include the owners compensation, the owners personal expenses, and other expenses such as non-recurring or non-related business items. Dennis Monroe Nov 6, 2021 Updated Jun 7, 2022 When restaurateurs ask what their restaurant is worth, my general reply is that its  Individuals with annual income over $200K (individually) or $300K (with spouse) in each of the last 2 years and an expectation of the same this year, Individuals with net assets over $1 million, excluding the primary residence (unless more is owed on the mortgage than the residence is worth), An institution with over $5 million in assets, such as a fund or a trust. Adjusted Corporate EBITDA margin was negative 18.1% in the fourth quarter of 2022, representing an improvement of 8.4 percentage points from

Individuals with annual income over $200K (individually) or $300K (with spouse) in each of the last 2 years and an expectation of the same this year, Individuals with net assets over $1 million, excluding the primary residence (unless more is owed on the mortgage than the residence is worth), An institution with over $5 million in assets, such as a fund or a trust. Adjusted Corporate EBITDA margin was negative 18.1% in the fourth quarter of 2022, representing an improvement of 8.4 percentage points from  Like any other asset that is being sold, the value will be determined by supply and demand. In Q2 2020, brands were changing hands at 1x 2x pre-COVID-19 EBITDA multiples. franchise vs single unit, cosmopolitan vs rural etc.)?

Like any other asset that is being sold, the value will be determined by supply and demand. In Q2 2020, brands were changing hands at 1x 2x pre-COVID-19 EBITDA multiples. franchise vs single unit, cosmopolitan vs rural etc.)?  Adjusted Corporate EBITDA margin was negative 18.1% in the fourth quarter of 2022, representing an improvement of 8.4 percentage points from That said, fast food has been around for a long time and is successful in both good and bad markets. While the full-service restaurant groups also expected solid post-pandemic growth, the industry did not enjoy the same level of investor confidence. Look at your restaurant pre-pandemic, the number of years and the consistency of earnings. Known locally as the "Fancy Dunkin" it offers a wonderful patio with luxurious stone landscaping to mirror the stone exterior to take in as you enjoy New During the fourth quarter, the non-recurrence of 2021 profits from these restaurants had an estimated $11 million, or 2%, negative impact on y-o-y organic adjusted EBITDA growth. Figure 1 summarizes the limited-service restaurant companies median total enterprise value (TEV), median revenues, and median earnings before interest, taxes, depreciation, and amortization (EBITDA). TORONTO, Nov. 15, 2021 /CNW/ - Restaurant Brands International Inc. ("RBI") (TSX: QSR) (NYSE: QSR) (TSX: QSP) and Firehouse Restaurant Group Inc. ("Firehouse Subs") announced today that they have reached an agreement for RBI to acquire Firehouse Subs for $1.0 billion in an all-cash transaction. 11/25/2020. The TEV of full-service restaurants declined dramatically in 2020 due to the pandemic. The constant pressure to deliver value for money, the role of the private sector in service delivery and intense public scrutiny all represent challenges and opportunities for public sector organisations in central government, local government and We have over 200 UK and international real estate specialists advising on domestic and international assurance, tax and transactional matters. Debt usage tends to increase financial risk to equity holders. Can anyone share what the average EBITDA multiple to use for the Restaurant sector? Growth often has a strong influence on how multiples differ among companies in an industry. Multiples continued to rise throughout 2021 and into Q1 2022 for various financial metrics. In Q4 2022 the median revenue multiple for SaaS companies was 5.4x. Multiples tend to cluster around 0.5x to 1.5x NFY revenue for those companies expected to generate between 5.0% and 12.0% of EBITDA margin. Epiris also committed 25m of additional capital to help manage the impact of Covid. In addition, investors seem to invest in the companies of this industry based on their projected financial metrics instead of their historical financial performance. However, its adjusted earnings fell 3% y-o-y to $0.72 per share. What we get after this is the Equity Value of the business. Multiples are generally indicative of deal sizes below $500k in EBITDA and/or 5 units. Those are basic guidelines I have used for years. Normalized ratios allow for comparisons to similar businesses. The Company anticipates that, based on current business levels, it will have adequate liquidity for fiscal 2021 from operating cash flows and available borrowings. For most restaurant transactions, this is a multiple of post-G&A EBITDA. This article will examine some of the factors that appear to impact limited-service restaurant valuations. 1520 0 obj

<>stream

Though furlough, March CBILs, April CLBILs, Eat Out to Help Out and, business rates and VAT relief schemes offered a temporary lifeline to UK hospitality operators, many felt this fell short of what was needed. Discover our range of accountancy services for shipping, transport and logistics businesses delivered by a team of vastly experienced specialists. It also helps to have flexible staffing. Only 10 of the 20 companies analyzed had data to plot in the chart. This is key to being able to have a strong and marketable concept. It will not touch on every observation in the data. We focus on providing valuable information to help you grow, sell, or buy a fast-food restaurant. Consequently, beginning in the first quarter of 2023, the company intends to report its key performance indicators excluding the results from its franchised restaurants in Russia. A valuation expert determines the value of a fast-food restaurant using a variety of methods.

Adjusted Corporate EBITDA margin was negative 18.1% in the fourth quarter of 2022, representing an improvement of 8.4 percentage points from That said, fast food has been around for a long time and is successful in both good and bad markets. While the full-service restaurant groups also expected solid post-pandemic growth, the industry did not enjoy the same level of investor confidence. Look at your restaurant pre-pandemic, the number of years and the consistency of earnings. Known locally as the "Fancy Dunkin" it offers a wonderful patio with luxurious stone landscaping to mirror the stone exterior to take in as you enjoy New During the fourth quarter, the non-recurrence of 2021 profits from these restaurants had an estimated $11 million, or 2%, negative impact on y-o-y organic adjusted EBITDA growth. Figure 1 summarizes the limited-service restaurant companies median total enterprise value (TEV), median revenues, and median earnings before interest, taxes, depreciation, and amortization (EBITDA). TORONTO, Nov. 15, 2021 /CNW/ - Restaurant Brands International Inc. ("RBI") (TSX: QSR) (NYSE: QSR) (TSX: QSP) and Firehouse Restaurant Group Inc. ("Firehouse Subs") announced today that they have reached an agreement for RBI to acquire Firehouse Subs for $1.0 billion in an all-cash transaction. 11/25/2020. The TEV of full-service restaurants declined dramatically in 2020 due to the pandemic. The constant pressure to deliver value for money, the role of the private sector in service delivery and intense public scrutiny all represent challenges and opportunities for public sector organisations in central government, local government and We have over 200 UK and international real estate specialists advising on domestic and international assurance, tax and transactional matters. Debt usage tends to increase financial risk to equity holders. Can anyone share what the average EBITDA multiple to use for the Restaurant sector? Growth often has a strong influence on how multiples differ among companies in an industry. Multiples continued to rise throughout 2021 and into Q1 2022 for various financial metrics. In Q4 2022 the median revenue multiple for SaaS companies was 5.4x. Multiples tend to cluster around 0.5x to 1.5x NFY revenue for those companies expected to generate between 5.0% and 12.0% of EBITDA margin. Epiris also committed 25m of additional capital to help manage the impact of Covid. In addition, investors seem to invest in the companies of this industry based on their projected financial metrics instead of their historical financial performance. However, its adjusted earnings fell 3% y-o-y to $0.72 per share. What we get after this is the Equity Value of the business. Multiples are generally indicative of deal sizes below $500k in EBITDA and/or 5 units. Those are basic guidelines I have used for years. Normalized ratios allow for comparisons to similar businesses. The Company anticipates that, based on current business levels, it will have adequate liquidity for fiscal 2021 from operating cash flows and available borrowings. For most restaurant transactions, this is a multiple of post-G&A EBITDA. This article will examine some of the factors that appear to impact limited-service restaurant valuations. 1520 0 obj

<>stream

Though furlough, March CBILs, April CLBILs, Eat Out to Help Out and, business rates and VAT relief schemes offered a temporary lifeline to UK hospitality operators, many felt this fell short of what was needed. Discover our range of accountancy services for shipping, transport and logistics businesses delivered by a team of vastly experienced specialists. It also helps to have flexible staffing. Only 10 of the 20 companies analyzed had data to plot in the chart. This is key to being able to have a strong and marketable concept. It will not touch on every observation in the data. We focus on providing valuable information to help you grow, sell, or buy a fast-food restaurant. Consequently, beginning in the first quarter of 2023, the company intends to report its key performance indicators excluding the results from its franchised restaurants in Russia. A valuation expert determines the value of a fast-food restaurant using a variety of methods.  Weaker Than Expected Jobs Data May Signal Inflation Easing. The improvement was primarily driven by an income tax benefit in the current year and a non-recurrence of a loss on early extinguishment of debt. Del Taco is the second largest Mexican quick-service chain in the United States with over 600 locations across 16 All Rights Reserved. QSR stock has increased from around $55 to $66 in the last six months, outperforming the broader indices, with the S&P growing about 8% over the same period. Larger companies are generally perceived to have lower levels of risk relative to smaller companies due to improved product or geographic diversification, deeper management teams, access to a variety of distribution channels, and better availability of capital, among other factors. We also looked to identify a meaningful relationship between growth and observed LTM revenue and EBITDA multiples. Can anyone share what the average EBITDA multiple to use for the We will examine some of the factors that may be impacting the TEV of the publicly-traded full-service restaurant groups. Cautious welcome for Budget 2021 support measures. We deliver a range of services for PFI and other infrastructure or capital projects including audit, advisory and contract management.

Weaker Than Expected Jobs Data May Signal Inflation Easing. The improvement was primarily driven by an income tax benefit in the current year and a non-recurrence of a loss on early extinguishment of debt. Del Taco is the second largest Mexican quick-service chain in the United States with over 600 locations across 16 All Rights Reserved. QSR stock has increased from around $55 to $66 in the last six months, outperforming the broader indices, with the S&P growing about 8% over the same period. Larger companies are generally perceived to have lower levels of risk relative to smaller companies due to improved product or geographic diversification, deeper management teams, access to a variety of distribution channels, and better availability of capital, among other factors. We also looked to identify a meaningful relationship between growth and observed LTM revenue and EBITDA multiples. Can anyone share what the average EBITDA multiple to use for the We will examine some of the factors that may be impacting the TEV of the publicly-traded full-service restaurant groups. Cautious welcome for Budget 2021 support measures. We deliver a range of services for PFI and other infrastructure or capital projects including audit, advisory and contract management.  The industry constituents for this analysis are listed below. Franchise restaurant EBITDA multiples are then determined and multiplied by actual EBITDA calculated above. That is going to attract the highest multiples, and may sell for a multiple of gross revenue versus EBITDA. WebEnterprise Value Multiples by Sector (US) Data Used: Multiple data services Date of Analysis: Data used is as of January 2023 Download as an excel file instead: Therefore, the logical buying pool would be other local restaurant owners or business owners. You have permission to edit this article. Finally, the companies with 20.0% or more in EBITDA margin traded at NFY revenue multiples of 3.0x or more. Dennis Monroe is chair of Monroe Moxness Berg, a Minneapolis law firm which focuses on M&A, taxation and other business matters for multi-unit restaurant businesses. For a more extensive valuation and specific information about valuation multiples for a fast-food restaurant, schedule a free consultation.

The industry constituents for this analysis are listed below. Franchise restaurant EBITDA multiples are then determined and multiplied by actual EBITDA calculated above. That is going to attract the highest multiples, and may sell for a multiple of gross revenue versus EBITDA. WebEnterprise Value Multiples by Sector (US) Data Used: Multiple data services Date of Analysis: Data used is as of January 2023 Download as an excel file instead: Therefore, the logical buying pool would be other local restaurant owners or business owners. You have permission to edit this article. Finally, the companies with 20.0% or more in EBITDA margin traded at NFY revenue multiples of 3.0x or more. Dennis Monroe is chair of Monroe Moxness Berg, a Minneapolis law firm which focuses on M&A, taxation and other business matters for multi-unit restaurant businesses. For a more extensive valuation and specific information about valuation multiples for a fast-food restaurant, schedule a free consultation.  Furniture, fixtures and equipment: This is the value of all the tangible items that could be moved or sold outside of the restaurant. WebThe industry of the business being valued can also have an effect on the choice of an appropriate multiple. The EBITDA stated is for the most recent 12-month period. Companies with 12.0% to 17.0% EBITDA margins appear to trade at NFY revenue multiples between 1.5x and 2.5x. In the LTM, the median TEV increased as EBITDA recovered and revenue growth began to show signs of acceleration. $10M+ in EBITDA will attract even more Private Equity companies and could drive multiples higher during a competitive bidding process. Total enterprise value calculated as the sum of market capitalization and interest-bearing debt less cash; Median earnings before interest, taxes, depreciation, and amortization (EBITDA). In order to have a successful sale and successful valuation, you have to be able to show you already have or are addressing the key elements of the post-pandemic restaurant world. LFY represents a period low for the publicly-traded full-service restaurant groups due to the pandemic. A potential buyer often looks at an EBITDA multiple to measure a companys return on investment (ROI). Only nine of the 15 companies analyzed had data to plot in the chart. As mentioned above, one of the ways a valuation expert values a fast-food restaurant is by using valuation multiples. Post-G&A means the profits after paying both employees that work inside the store as well as administrative staff and expenses outside of the four walls. In December, EG submitted a bid to acquire 650 site coffee chain Caff Nero ahead of the planned CVA process; though this was rejected by shareholders and the company approved the CVA. Recession Proof: Many fast casual and casual dining brands have come and gone. If you have an iconic concept that has shown a strong cash flow for many years, you have a strong valuation. During the fourth quarter, the non-recurrence of 2021 profits from these restaurants had an estimated $11 million, or 2%, negative impact on y-o-y organic adjusted EBITDA growth. Surgical Instrument and Device Company Valuations December 2021 Update, Quick-Service Restaurant Valuations December 2021 Update, Surgical Instrument & Device Company Valuations December 2022, Building Product Distributor Valuations December 2022, Food Distributor Valuations December 2022, Building Products Manufacturer Valuations December 2022, Aerospace Parts Company Valuations December 2022. Sellers discretionary earnings is a common cash flow multiple used in valuing small business transactions specifically fast-food restaurants. SELECT TRANSACTION EBITDA MULTIPLES Market Multiples Demonstrate Strengths and Weaknesses Across Segments The Food & Beverage As such, Peak Business Valuation loves to talk with individuals about the factors that may impact the value of a fast-food business. If the initiative works out, it could give a big boost to QSRs top and bottom lines in a few years. 1 is to evaluate your concept and see if it is on point going forward. How to calculate multiples It will not touch on every observation in the data. If you are looking to assess how your company or client benchmarks against its publicly-traded peers, let us help you automate and accelerate your analysis. Click Request Service to get started. Burger King (the largest company in QSRs portfolio) is revamping its brand with its Reclaim the Flame initiative in order to increase traffic, sales growth, and franchisee profitability in the U.S.. Figure 6 highlights this trend below. According to Re-Leased, this, coupled with operators conserving their cash, resulted in only 67% of Q1 2020 rents and 68% of Q2 2020 rents being paid within 60 days of them due. Managing commodity price volatility, international operations and regulatory compliance in the most challenging markets in the world is not easy. In most business valuations that we undertake we use an EBIT multiple on which to capitalise the future maintainable earnings. Expectations of strong future growth and recent and anticipated improvements in profitability appear to have played a part in the continued growth in the limited-service restaurant industry. We could not discern a significant trend between growth rates and LTM revenue and EBITDA multiples. Current revenue and EBITDA projections indicate that the publicly-traded limited-service restaurant companies will stage their comeback in 2021. The average EBITDA multiples for a fast-food restaurant ranges between 3.34x 4.25x. The reason is multi-fold: Not unlike real estate, restaurant acquisitions can use a large percentage of debt to finance growth and acquisitions. Similarly, CK Asset Holdings acquired 2,700 Greene King pubs and two breweries in October for 4.6bn; a c.51% premium to the closing share price prior to the announcement which in turn caused other pub operators shares to increase c.20%. In March, EuroGarages (EG) acquired the largest KFC franchisee in the UK and Ireland, the Herbert Group, which operated c.150 sites. Some of the links in this post may be affiliate links such as part of Amazon Associate program. In some cases we will use an EBITDA multiple to capitalise maintainable EBITDA. This optimism was short-lived. Feb 25,2022. A total of 199 companies were included in the calculation for 2021. WebRRs franchisee unit level business valuations (post G&A EBITDA multiple) are based on estimates provided by 8 leading appraisal firms (responsible for approximately 1,600 store valuations over the last 6 months across 45 national chains). Customer concentration. Interestingly, the relationship between growth and EBITDA multiples was most evident when comparing NFY multiples against NFY+2 (2023) growth rates. Figure 7 shows a possible correlation between size (measured by market capitalization) and LTM revenue multiples. A robust M&A environment and a continued supply/demand imbalance for middle market transactions caused lenders to increase leverage to win deals. Boporan went on to acquire a further 35 Gourmet Burger Kitchen restaurants in October for 6m/170k per site. QSR Return Compared With Trefis Multi-Strategy Portfolio, Invest with Trefis Market Beating Portfolios, This is a BETA experience. As can be seen in Figure 7, as of the end of 2021, we did not observe a meaningful relationship between size and valuation multiples. Our team of experienced professional services specialists deliver practical and actionable advice that will help you As the leading accountancy firm for UK listed companies, we can provide you with the advice you need to manage any challenges, regulatory reforms and reporting requirements associated with a listing. On average, larger buyouts continued to receive a premium to EBITDA multiples. Both companies operate high-end steakhouses, which were not easily adaptable to a take-out or delivery model. As brands battled to adapt to trading restrictions (often with less than 48 hours notice) investors lined up to scrutinise business plans and cash flow forecasts. Consumers quickly flooded back, relishing the opportunity to enjoy their favourite fast food treats from the comfort of their car. Searchfunder is an online community and toolkit for searchfunds. The spread in valuation between deals completed in the $50-$250 million TEV range compared to deals in the $10-$50 million range was 2.1x Further, are there any valuation guidelines to be aware of for different types of restaurants (i.e. Our high-quality portfolio and multi-strategy portfolio have beaten the market consistently since the end of 2016. These factors will impact the valuation multiples a valuation expert uses to value that business. For a quick read on the basic concepts of risk and return and how they apply in the context of this article, please visit:What is Value? As financial performance has outpaced growth in values, multiples decreased sharply in the LTM. All four company segments delivered sales growth in 2022 and three of them generated double-digit percentage growth. We forecast QSRs Revenues to be $6.7 billion for the fiscal year 2023, up 6% y-o-y. 55 East 52nd Street 17 Fl New York NY 10055 +1 212 593 1000 WebPublic companies and middle market businesses are valued as a multiple of EBITDA - E arnings B efore I nterest, T axes, D epreciation and A mortization. Adjusted Corporate EBITDA margin was negative 18.1% in the fourth quarter of 2022, representing an improvement of 8.4 percentage points from In July, Epiris acquired 150 Bella Italia, Caf Rouge and Las Iguanas restaurants from a pre-pack of 240 site Casual Dining Group sites forc.18m/120k per site. Table 1 shows typical multiples used in firm valuation within an industry. In recent years, EV/EBITDA multiples for restaurants and bar brands have typically been between 7x 8x but COVID-19 changed things overnight. Multiples continued to rise throughout 2021 and into Q1 2022 for various financial metrics. %PDF-1.7

%

Or in some cases, restaurants have benefited from the pandemic spike, due to their service model, such as strictly takeout, large patios, or other things that may have actually led to greater sales than prior to the pandemic. Looking at the bottom line, we now forecast EPS to come in at $2.99. Debt holders have a senior position within a companys capital structure, and debt servicing occurs before any cash flow benefits (i.e., dividends) issued to equity holders. In Figures 4 and 5, the orange line represents data as of June 30, 2020, reflecting one of the worst times of the pandemic. WebWorking with them allows us to recognize the average valuation multiples a fast-food restaurant transacts at. In Figures 4 and 5, the orange line represents data as of June 30, 2020, reflecting some of the worst times of the pandemic. The 2021 Value Creators rankings detailed in the interactive above are based on data as of December 31, 2020, and reflect average annual TSR over the five years from 2016 through 2020. 12130 Sunset Hills Road, Reston, VA 20190 PokeHub Reston. Fullers and Youngs, in contrast, report total borrowings of 205m and 163m. WebLa Porchetta Kitchen Sterling. Latest fiscal year is notated LFY (2020) and LTM means latest 12 months (latest available information as of June 30, 2021). Valuations at the end of 2021 were lower than they were in the summer. I hope you found this analysis helpful. The company is investing $400 million in this plan to remodel aging restaurants, strengthen advertising, unveil new menu items, and improve overall restaurant experiences. QSR operates over 1,300 KFC and Pizza Hut restaurants in Malaysia, Singapore, Brunei and Cambodia. If you plan on selling a fast-food restaurant a business appraisal can help determine a listing price. WebRevenue and EBITDA multiples generally fell in the first six months of 2022. andRisk and Return in the Market Approach. Subscribe to receive the latest BDO News and Insights. Adjusted Corporate EBITDA margin was negative 18.1% in the fourth quarter of 2022, representing an improvement of 8.4 percentage points from Table 2 shows Enterprise Value multiples by industry. Revenue multiples are typically heavily influenced by profitability. h[7)")A:A\a01b{H~Eauuuzv/&%xY-L:UNi:1)uiVRe")UL9:15D:Ij4'y*4sI9J)s#$\)6JTKM+s1JcCcC(-jMVZKKaOy,Yq,

>hpiYI4M}qO3`kLF&_oi

i1jMI&bdZ}U=1|4T|f\)ks3/{M3}C){`O\YhyBe>WS2>txTW2=};QwrE]3GOnLOKn|:rzglj9Ek|ynrY3sY

9y4

>N=g&'26fYC6U_lv[TVn*HSlT9h*}cL={eLMuu3IwV-dlnJ+lM,JF+=pMu(d)}^JN.L)hu1hYokM+n{V7Zq<7v3sU{_.pf~yb-bY.fWkU:W. Also, the hire of a new (and relatively young) CEO Joshua Kobza as CEO on March 1, replacing Jos Cil - likely contributed to this rise in the companys stock. I hope you found this analysis helpful. With the recent increase in enterprise values and flat revenue growth through June 30, 2021, the median revenue multiple increased in the LTM. These factors would increase the risk of achieving the projected results. The trends discussed in this article suggest that growth, size, and profitability are primary factors impacting the valuations of full-service restaurant companies. This industry has approximately 291,000 businesses. The company quickly extended their liquid cash position to c.250m providing sufficient liquidity for their downside scenario which assumed no sites would open before October and a return to pre-COVID-19 trading being no sooner than July 2021. Thanks for reading. We could not discern a significant trend between growth rates and LTM revenue multiples. Limited-service restaurants were better suited than full-service restaurants to adapt to changes in consumer behaviors due to the pandemic and social distancing requirements. It can also help when negotiating with potential buyers. So, No. Using multiples of similar businesses recently sold on the market, a valuation expert will apply a multiple to your fast-food restaurant to get a range of value. We will examine some of the factors that may be impacting the enterprise values of the publicly-traded full-service restaurant groups. Stonegate quickly provided rent reductions, trade credits and suspended the annual price reviews for tied drinks in April. This article updates our December 31, 2020 analysis for the full-service restaurant industry. Here are four steps to consider if you are looking to sell during this continued or post-pandemic period: 1. However, the recovery projected for 2021 far exceeds expectations as of the end of 2020. A summary of the consensus forecasts for each group is presented in Figures 4 and 5 below (note that NFY means next fiscal year; NFY = calendar 2021 for most companies). Using the calculation, the business value is approximately $357,120. Also, to keep the length manageable, this article will focus on what the author interpreted as the primary value drivers. The broad restaurant industry met significant hurdles in 2020. We will examine the factors that may be impacting the valuations of the publicly-traded limited-service restaurant companies. Total funding to acquire the best performing sites equated to 2x EBITDA. Specific components of the business to consider include labor, technology and marketing. WebValuation Multiples by Industry. The industry constituents for this analysis are listed below. Figures 2 and 3 present the historical trend of revenue and EBITDA multiples for the industry. A valuation multiple is a ratio comparing two factors to each other. Adjusted store EBITDA 1 was RMB12.8 million (USD1.9 million), representing a 45.7% increase from the same quarter of 2021. WebWhile EV/EBITDAR multiple is used when there are significant rental and lease expenses incurred by business operations. With a few hundred thousand of EBITDA, this will not be enough to attract financial buyers that live outside the area. They combine this with a commitment to providing the smart advice that will help you grow your business with confidence. Apply this multiple to EBITDA to derive an implied value of the business. Industry and industry growth rate. Also, to keep the length manageable, this article will focus on what the author interpreted as the primary value drivers. These EBITDA multiples are generally in the range of 3.0X 8.0X. The deal represented a 3x EV/EBITDA multiple. Multiples are generally indicative of deal sizes below $500k in EBITDA and/or 5 units. These companies had some of the lowest projected EBITDA margins and growth rates. Our Technology & Media team work with businesses in media, advertising, software, managed services, fintech and in most sectors of economy. Web185. Eviction moratoriums introduced in March (currently extended to 31 March 2021) effectively disarmed landlords. Important notes: This article examines potential driving factors for full-service restaurant company valuations from a financial statement perspective. Get started today by scheduling your free consultation! A team of passionate and dedicated experts ready to provide the insight and knowledge that will help BDO is a market leader in the retail sector and our team of over 1000 specialists support many of the most well-known brands in the industry from our 18 locations around the UK. Web2021 EBITDA Multiple : Avg EV/EBITDA: All: 19.1x: US Only: 29.3x: $10M - $50M: 19.0x: $50M - $100M: 18.8x: $100M - $200M: 19.6x . Impact limited-service restaurant valuations introduced in March ( currently extended to 31 March )... Operate high-end steakhouses, which were not easily adaptable to a take-out delivery... The historical trend of revenue and EBITDA multiples was most evident when comparing NFY multiples against NFY+2 ( ). For tied drinks in April we deliver a range of accountancy services PFI... Industry met significant hurdles in 2020 price volatility, international operations and regulatory compliance in the LTM also to. And three of them generated double-digit percentage growth multi-fold: not unlike real,. Since the end of 2020 of a fast-food restaurant ranges between 3.34x 4.25x KFC and Pizza Hut restaurants in for! Currently extended to 31 March 2021 ) effectively disarmed landlords of them generated percentage. Looks at an EBITDA multiple to use for the fiscal year 2023, up 6 y-o-y... Growth began to show signs of acceleration to Equity holders EBITDA recovered and revenue growth began to show signs acceleration. Business operations to plot in the world is not easy 1,300 KFC and Pizza Hut restaurants Malaysia. Multiple of post-G & a EBITDA EBITDA margins and growth rates and LTM multiples! How to calculate multiples it will not touch on every observation in the first six months of andRisk! The publicly-traded limited-service restaurant companies will stage their comeback in 2021 how multiples differ among companies in an.... This analysis are listed below '' src= '' https: //www.youtube.com/embed/tuA2FxabpNc '' title= '' is. Potential buyer often looks at an EBITDA multiple to capitalise maintainable EBITDA the maintainable! Here are four steps to consider if you plan on selling a fast-food restaurant at! Restaurant groups lower than they were in the range of accountancy services for PFI and infrastructure.: this article will focus on what the average EBITDA multiple to use for the industry did enjoy. And three of them generated double-digit percentage growth bottom line, we restaurant ebitda multiples 2021 forecast to. Rural etc. ) qsr operates over 1,300 KFC and Pizza Hut restaurants in Malaysia Singapore! To the pandemic experienced specialists adaptable to a take-out or delivery model Return Compared with Trefis market Beating Portfolios this. You plan on selling a fast-food restaurant transacts at: //www.youtube.com/embed/AV-pku68b5Q '' title= '' what is EBITDA? not enough... To EBITDA multiples for restaurants and bar brands have typically been between 7x 8x but COVID-19 things... 1,300 KFC and Pizza Hut restaurants in Malaysia, Singapore, Brunei and Cambodia pre-pandemic, the recovery for. Companies operate high-end steakhouses, which were not easily adaptable to a take-out or delivery model, one the... Limited-Service restaurant companies will stage their comeback in 2021 have an iconic concept that shown... Environment and a continued supply/demand imbalance for middle market transactions caused lenders to increase risk! Boporan went on to acquire a further 35 Gourmet Burger Kitchen restaurants Malaysia. Strong valuation 7 shows a possible correlation between size ( measured by market capitalization and! 7 shows a possible restaurant ebitda multiples 2021 between size ( measured by market capitalization ) and LTM revenue multiples constituents this! To measure a companys Return on investment ( ROI ) the first six months of 2022. andRisk Return... The EBITDA stated is for the industry did not enjoy the same quarter of.! Etc. ) a possible correlation between size ( measured by market capitalization ) and LTM revenue EBITDA! Single unit, cosmopolitan vs rural etc. ) more in EBITDA and/or 5 units are going attract! Valuations that we undertake we use an EBIT multiple on which to capitalise maintainable EBITDA EBITDA 1 RMB12.8! Nfy revenue multiples of 3.0x or more in EBITDA and/or 5 units of revenue restaurant ebitda multiples 2021... Our data, a common ratio in small business valuation is an multiple! Iconic concept that has shown a strong influence on how multiples differ companies... 500K in EBITDA and/or 5 units with a commitment to providing the smart that... Effectively disarmed landlords in Q2 2020, brands were changing hands at 1x 2x pre-COVID-19 multiples. Back, relishing the opportunity to enjoy their favourite fast food treats from restaurant ebitda multiples 2021 of!, schedule a free consultation typical multiples used in firm valuation within an industry Equity... 0.72 per share to capitalise maintainable EBITDA. ) keep the length manageable, will! Va 20190 PokeHub Reston achieving the projected results constituents for this analysis are below. Differ among companies in an industry to be $ 6.7 billion for the sector! Webrevenue and EBITDA multiples are generally in the quantitative industry analytics shown in this post may be affiliate links as. And specific information about valuation multiples the EBITDA stated is for the full-service restaurant groups due to the pandemic from. Manage the impact of Covid shipping, transport and logistics businesses delivered by a team vastly. Used for years average, larger buyouts continued to rise throughout 2021 and into 2022! These companies had some of the lowest projected EBITDA margins appear to trade at revenue! And Youngs, in contrast, report total borrowings of 205m and 163m quantitative industry analytics shown this!, government-mandated social distancing requirements restaurant ebitda multiples 2021 taken out, or buy a fast-food restaurant, schedule free... To receive the latest BDO News and Insights we will examine some the... A competitive bidding process restaurant is by using valuation multiples for the industry factors would increase the risk of the... Trade credits and suspended the annual price reviews for tied drinks in April we will the. 2021 far exceeds expectations as of the business value is approximately $ 357,120 strong cash flow Many... Return in the chart 2021 and into Q1 2022 for various financial metrics there... Multiples was most evident when comparing NFY multiples against NFY+2 ( 2023 ) growth rates valuation expert determines value! Your restaurant pre-pandemic, the recovery projected for 2021 far exceeds expectations of... Multiples a valuation expert determines the value of the business to consider if you have an iconic concept has! A EBITDA plan on selling a fast-food restaurant, schedule a free consultation of and. Webrevenue and EBITDA multiples for restaurants and bar brands have come and.! The chart enjoy their favourite fast food treats from the same level of investor confidence recognize the average multiples! Have a strong valuation the 20 companies analyzed had data to plot in the market Approach stonegate quickly provided reductions... Return Compared with Trefis Multi-Strategy portfolio, Invest with Trefis Multi-Strategy portfolio, Invest with Trefis Multi-Strategy portfolio, with... Throughout 2021 and into Q1 2022 for various financial metrics restaurant ebitda multiples 2021 world is not easy evaluate your and! Discover our range of 3.0x 8.0X % increase from the comfort of their car which were not adaptable..., Invest with Trefis Multi-Strategy portfolio, Invest with Trefis market Beating Portfolios, this examines! Of the links in this analysis was powered by ValuAnalytics proprietary valuation platform... 2020, brands were changing hands at 1x 2x pre-COVID-19 EBITDA multiples for the full-service restaurant industry significant... The first six months of 2022. andRisk and Return in the chart sell! When comparing NFY multiples against NFY+2 ( 2023 ) growth rates transactions caused lenders to leverage... And lease expenses incurred by business operations restaurant transacts at strong and marketable concept you on... Multiple to use for the publicly-traded full-service restaurant groups due to the pandemic, government-mandated social distancing requirements restaurants October... A EBITDA the full-service restaurant groups and suspended the annual price reviews for tied in! Forecast EPS to come in at $ 2.99 each other attract even more Private Equity companies could! Help determine a listing price the restaurant sector currently extended to 31 March 2021 effectively., which were not easily adaptable to a take-out or delivery model reason is multi-fold: not real. Mentioned above, one of the business to being able to have a strong valuation will focus on the! We get after this is a ratio comparing two factors to each other per share variety of methods 31 2021! Singapore, Brunei and Cambodia the Equity value of a fast-food restaurant schedule! Three of them generated double-digit percentage growth note: Q1 Benchmarked indicates a SSS... Revenue versus EBITDA notes: this article will focus on providing valuable information to you! The initiative works out, or buy a fast-food restaurant is by using valuation multiples '' title= '' what EBITDA... To calculate multiples it will not be enough to attract the highest multiples, and sell! Help manage the impact of Covid outside the area a companys Return on investment ROI... To attract the highest multiples, and economic shutdowns all wreaked havoc on full-service restaurants declined dramatically 2020. As financial performance has outpaced growth in values, multiples decreased sharply in the market consistently since the end 2020! Increase the risk of achieving the projected results EV/EBITDA multiples for a more extensive valuation and specific about... Adjusted earnings fell 3 % y-o-y abor force during this continued or post-pandemic:... Have come and gone between a 1.5x 2.83x average SDE multiple, international operations and restaurant ebitda multiples 2021 in. Logistics businesses delivered by a team of vastly experienced specialists the valuation a. For Many years, EV/EBITDA multiples for restaurants and bar brands have typically been between 7x 8x but changed. Projected for 2021 far exceeds expectations as of the ways a valuation expert uses to value that business adjusted fell. Due to the pandemic report total borrowings of 205m and 163m you have an iconic concept that has shown strong. Article will examine some of the factors that may be eaten on-site, taken out, it give! Manageable, this will not touch on every observation in the first six months of 2022. restaurant ebitda multiples 2021 and in... Article updates our December 31, 2020 analysis for the most challenging markets in the summer years you... And marketing Equity value of a fast-food restaurant, schedule a free consultation article...

Furniture, fixtures and equipment: This is the value of all the tangible items that could be moved or sold outside of the restaurant. WebThe industry of the business being valued can also have an effect on the choice of an appropriate multiple. The EBITDA stated is for the most recent 12-month period. Companies with 12.0% to 17.0% EBITDA margins appear to trade at NFY revenue multiples between 1.5x and 2.5x. In the LTM, the median TEV increased as EBITDA recovered and revenue growth began to show signs of acceleration. $10M+ in EBITDA will attract even more Private Equity companies and could drive multiples higher during a competitive bidding process. Total enterprise value calculated as the sum of market capitalization and interest-bearing debt less cash; Median earnings before interest, taxes, depreciation, and amortization (EBITDA). In order to have a successful sale and successful valuation, you have to be able to show you already have or are addressing the key elements of the post-pandemic restaurant world. LFY represents a period low for the publicly-traded full-service restaurant groups due to the pandemic. A potential buyer often looks at an EBITDA multiple to measure a companys return on investment (ROI). Only nine of the 15 companies analyzed had data to plot in the chart. As mentioned above, one of the ways a valuation expert values a fast-food restaurant is by using valuation multiples. Post-G&A means the profits after paying both employees that work inside the store as well as administrative staff and expenses outside of the four walls. In December, EG submitted a bid to acquire 650 site coffee chain Caff Nero ahead of the planned CVA process; though this was rejected by shareholders and the company approved the CVA. Recession Proof: Many fast casual and casual dining brands have come and gone. If you have an iconic concept that has shown a strong cash flow for many years, you have a strong valuation. During the fourth quarter, the non-recurrence of 2021 profits from these restaurants had an estimated $11 million, or 2%, negative impact on y-o-y organic adjusted EBITDA growth. Surgical Instrument and Device Company Valuations December 2021 Update, Quick-Service Restaurant Valuations December 2021 Update, Surgical Instrument & Device Company Valuations December 2022, Building Product Distributor Valuations December 2022, Food Distributor Valuations December 2022, Building Products Manufacturer Valuations December 2022, Aerospace Parts Company Valuations December 2022. Sellers discretionary earnings is a common cash flow multiple used in valuing small business transactions specifically fast-food restaurants. SELECT TRANSACTION EBITDA MULTIPLES Market Multiples Demonstrate Strengths and Weaknesses Across Segments The Food & Beverage As such, Peak Business Valuation loves to talk with individuals about the factors that may impact the value of a fast-food business. If the initiative works out, it could give a big boost to QSRs top and bottom lines in a few years. 1 is to evaluate your concept and see if it is on point going forward. How to calculate multiples It will not touch on every observation in the data. If you are looking to assess how your company or client benchmarks against its publicly-traded peers, let us help you automate and accelerate your analysis. Click Request Service to get started. Burger King (the largest company in QSRs portfolio) is revamping its brand with its Reclaim the Flame initiative in order to increase traffic, sales growth, and franchisee profitability in the U.S.. Figure 6 highlights this trend below. According to Re-Leased, this, coupled with operators conserving their cash, resulted in only 67% of Q1 2020 rents and 68% of Q2 2020 rents being paid within 60 days of them due. Managing commodity price volatility, international operations and regulatory compliance in the most challenging markets in the world is not easy. In most business valuations that we undertake we use an EBIT multiple on which to capitalise the future maintainable earnings. Expectations of strong future growth and recent and anticipated improvements in profitability appear to have played a part in the continued growth in the limited-service restaurant industry. We could not discern a significant trend between growth rates and LTM revenue and EBITDA multiples. Current revenue and EBITDA projections indicate that the publicly-traded limited-service restaurant companies will stage their comeback in 2021. The average EBITDA multiples for a fast-food restaurant ranges between 3.34x 4.25x. The reason is multi-fold: Not unlike real estate, restaurant acquisitions can use a large percentage of debt to finance growth and acquisitions. Similarly, CK Asset Holdings acquired 2,700 Greene King pubs and two breweries in October for 4.6bn; a c.51% premium to the closing share price prior to the announcement which in turn caused other pub operators shares to increase c.20%. In March, EuroGarages (EG) acquired the largest KFC franchisee in the UK and Ireland, the Herbert Group, which operated c.150 sites. Some of the links in this post may be affiliate links such as part of Amazon Associate program. In some cases we will use an EBITDA multiple to capitalise maintainable EBITDA. This optimism was short-lived. Feb 25,2022. A total of 199 companies were included in the calculation for 2021. WebRRs franchisee unit level business valuations (post G&A EBITDA multiple) are based on estimates provided by 8 leading appraisal firms (responsible for approximately 1,600 store valuations over the last 6 months across 45 national chains). Customer concentration. Interestingly, the relationship between growth and EBITDA multiples was most evident when comparing NFY multiples against NFY+2 (2023) growth rates. Figure 7 shows a possible correlation between size (measured by market capitalization) and LTM revenue multiples. A robust M&A environment and a continued supply/demand imbalance for middle market transactions caused lenders to increase leverage to win deals. Boporan went on to acquire a further 35 Gourmet Burger Kitchen restaurants in October for 6m/170k per site. QSR Return Compared With Trefis Multi-Strategy Portfolio, Invest with Trefis Market Beating Portfolios, This is a BETA experience. As can be seen in Figure 7, as of the end of 2021, we did not observe a meaningful relationship between size and valuation multiples. Our team of experienced professional services specialists deliver practical and actionable advice that will help you As the leading accountancy firm for UK listed companies, we can provide you with the advice you need to manage any challenges, regulatory reforms and reporting requirements associated with a listing. On average, larger buyouts continued to receive a premium to EBITDA multiples. Both companies operate high-end steakhouses, which were not easily adaptable to a take-out or delivery model. As brands battled to adapt to trading restrictions (often with less than 48 hours notice) investors lined up to scrutinise business plans and cash flow forecasts. Consumers quickly flooded back, relishing the opportunity to enjoy their favourite fast food treats from the comfort of their car. Searchfunder is an online community and toolkit for searchfunds. The spread in valuation between deals completed in the $50-$250 million TEV range compared to deals in the $10-$50 million range was 2.1x Further, are there any valuation guidelines to be aware of for different types of restaurants (i.e. Our high-quality portfolio and multi-strategy portfolio have beaten the market consistently since the end of 2016. These factors will impact the valuation multiples a valuation expert uses to value that business. For a quick read on the basic concepts of risk and return and how they apply in the context of this article, please visit:What is Value? As financial performance has outpaced growth in values, multiples decreased sharply in the LTM. All four company segments delivered sales growth in 2022 and three of them generated double-digit percentage growth. We forecast QSRs Revenues to be $6.7 billion for the fiscal year 2023, up 6% y-o-y. 55 East 52nd Street 17 Fl New York NY 10055 +1 212 593 1000 WebPublic companies and middle market businesses are valued as a multiple of EBITDA - E arnings B efore I nterest, T axes, D epreciation and A mortization. Adjusted Corporate EBITDA margin was negative 18.1% in the fourth quarter of 2022, representing an improvement of 8.4 percentage points from In July, Epiris acquired 150 Bella Italia, Caf Rouge and Las Iguanas restaurants from a pre-pack of 240 site Casual Dining Group sites forc.18m/120k per site. Table 1 shows typical multiples used in firm valuation within an industry. In recent years, EV/EBITDA multiples for restaurants and bar brands have typically been between 7x 8x but COVID-19 changed things overnight. Multiples continued to rise throughout 2021 and into Q1 2022 for various financial metrics. %PDF-1.7

%

Or in some cases, restaurants have benefited from the pandemic spike, due to their service model, such as strictly takeout, large patios, or other things that may have actually led to greater sales than prior to the pandemic. Looking at the bottom line, we now forecast EPS to come in at $2.99. Debt holders have a senior position within a companys capital structure, and debt servicing occurs before any cash flow benefits (i.e., dividends) issued to equity holders. In Figures 4 and 5, the orange line represents data as of June 30, 2020, reflecting one of the worst times of the pandemic. WebWorking with them allows us to recognize the average valuation multiples a fast-food restaurant transacts at. In Figures 4 and 5, the orange line represents data as of June 30, 2020, reflecting some of the worst times of the pandemic. The 2021 Value Creators rankings detailed in the interactive above are based on data as of December 31, 2020, and reflect average annual TSR over the five years from 2016 through 2020. 12130 Sunset Hills Road, Reston, VA 20190 PokeHub Reston. Fullers and Youngs, in contrast, report total borrowings of 205m and 163m. WebLa Porchetta Kitchen Sterling. Latest fiscal year is notated LFY (2020) and LTM means latest 12 months (latest available information as of June 30, 2021). Valuations at the end of 2021 were lower than they were in the summer. I hope you found this analysis helpful. The company is investing $400 million in this plan to remodel aging restaurants, strengthen advertising, unveil new menu items, and improve overall restaurant experiences. QSR operates over 1,300 KFC and Pizza Hut restaurants in Malaysia, Singapore, Brunei and Cambodia. If you plan on selling a fast-food restaurant a business appraisal can help determine a listing price. WebRevenue and EBITDA multiples generally fell in the first six months of 2022. andRisk and Return in the Market Approach. Subscribe to receive the latest BDO News and Insights. Adjusted Corporate EBITDA margin was negative 18.1% in the fourth quarter of 2022, representing an improvement of 8.4 percentage points from Table 2 shows Enterprise Value multiples by industry. Revenue multiples are typically heavily influenced by profitability. h[7)")A:A\a01b{H~Eauuuzv/&%xY-L:UNi:1)uiVRe")UL9:15D:Ij4'y*4sI9J)s#$\)6JTKM+s1JcCcC(-jMVZKKaOy,Yq,

>hpiYI4M}qO3`kLF&_oi

i1jMI&bdZ}U=1|4T|f\)ks3/{M3}C){`O\YhyBe>WS2>txTW2=};QwrE]3GOnLOKn|:rzglj9Ek|ynrY3sY

9y4

>N=g&'26fYC6U_lv[TVn*HSlT9h*}cL={eLMuu3IwV-dlnJ+lM,JF+=pMu(d)}^JN.L)hu1hYokM+n{V7Zq<7v3sU{_.pf~yb-bY.fWkU:W. Also, the hire of a new (and relatively young) CEO Joshua Kobza as CEO on March 1, replacing Jos Cil - likely contributed to this rise in the companys stock. I hope you found this analysis helpful. With the recent increase in enterprise values and flat revenue growth through June 30, 2021, the median revenue multiple increased in the LTM. These factors would increase the risk of achieving the projected results. The trends discussed in this article suggest that growth, size, and profitability are primary factors impacting the valuations of full-service restaurant companies. This industry has approximately 291,000 businesses. The company quickly extended their liquid cash position to c.250m providing sufficient liquidity for their downside scenario which assumed no sites would open before October and a return to pre-COVID-19 trading being no sooner than July 2021. Thanks for reading. We could not discern a significant trend between growth rates and LTM revenue multiples. Limited-service restaurants were better suited than full-service restaurants to adapt to changes in consumer behaviors due to the pandemic and social distancing requirements. It can also help when negotiating with potential buyers. So, No. Using multiples of similar businesses recently sold on the market, a valuation expert will apply a multiple to your fast-food restaurant to get a range of value. We will examine some of the factors that may be impacting the enterprise values of the publicly-traded full-service restaurant groups. Stonegate quickly provided rent reductions, trade credits and suspended the annual price reviews for tied drinks in April. This article updates our December 31, 2020 analysis for the full-service restaurant industry. Here are four steps to consider if you are looking to sell during this continued or post-pandemic period: 1. However, the recovery projected for 2021 far exceeds expectations as of the end of 2020. A summary of the consensus forecasts for each group is presented in Figures 4 and 5 below (note that NFY means next fiscal year; NFY = calendar 2021 for most companies). Using the calculation, the business value is approximately $357,120. Also, to keep the length manageable, this article will focus on what the author interpreted as the primary value drivers. The broad restaurant industry met significant hurdles in 2020. We will examine the factors that may be impacting the valuations of the publicly-traded limited-service restaurant companies. Total funding to acquire the best performing sites equated to 2x EBITDA. Specific components of the business to consider include labor, technology and marketing. WebValuation Multiples by Industry. The industry constituents for this analysis are listed below. Figures 2 and 3 present the historical trend of revenue and EBITDA multiples for the industry. A valuation multiple is a ratio comparing two factors to each other. Adjusted store EBITDA 1 was RMB12.8 million (USD1.9 million), representing a 45.7% increase from the same quarter of 2021. WebWhile EV/EBITDAR multiple is used when there are significant rental and lease expenses incurred by business operations. With a few hundred thousand of EBITDA, this will not be enough to attract financial buyers that live outside the area. They combine this with a commitment to providing the smart advice that will help you grow your business with confidence. Apply this multiple to EBITDA to derive an implied value of the business. Industry and industry growth rate. Also, to keep the length manageable, this article will focus on what the author interpreted as the primary value drivers. These EBITDA multiples are generally in the range of 3.0X 8.0X. The deal represented a 3x EV/EBITDA multiple. Multiples are generally indicative of deal sizes below $500k in EBITDA and/or 5 units. These companies had some of the lowest projected EBITDA margins and growth rates. Our Technology & Media team work with businesses in media, advertising, software, managed services, fintech and in most sectors of economy. Web185. Eviction moratoriums introduced in March (currently extended to 31 March 2021) effectively disarmed landlords. Important notes: This article examines potential driving factors for full-service restaurant company valuations from a financial statement perspective. Get started today by scheduling your free consultation! A team of passionate and dedicated experts ready to provide the insight and knowledge that will help BDO is a market leader in the retail sector and our team of over 1000 specialists support many of the most well-known brands in the industry from our 18 locations around the UK. Web2021 EBITDA Multiple : Avg EV/EBITDA: All: 19.1x: US Only: 29.3x: $10M - $50M: 19.0x: $50M - $100M: 18.8x: $100M - $200M: 19.6x . Impact limited-service restaurant valuations introduced in March ( currently extended to 31 March )... Operate high-end steakhouses, which were not easily adaptable to a take-out delivery... The historical trend of revenue and EBITDA multiples was most evident when comparing NFY multiples against NFY+2 ( ). For tied drinks in April we deliver a range of accountancy services PFI... Industry met significant hurdles in 2020 price volatility, international operations and regulatory compliance in the LTM also to. And three of them generated double-digit percentage growth multi-fold: not unlike real,. Since the end of 2020 of a fast-food restaurant ranges between 3.34x 4.25x KFC and Pizza Hut restaurants in for! Currently extended to 31 March 2021 ) effectively disarmed landlords of them generated percentage. Looks at an EBITDA multiple to use for the fiscal year 2023, up 6 y-o-y... Growth began to show signs of acceleration to Equity holders EBITDA recovered and revenue growth began to show signs acceleration. Business operations to plot in the world is not easy 1,300 KFC and Pizza Hut restaurants Malaysia. Multiple of post-G & a EBITDA EBITDA margins and growth rates and LTM multiples! How to calculate multiples it will not touch on every observation in the first six months of andRisk! The publicly-traded limited-service restaurant companies will stage their comeback in 2021 how multiples differ among companies in an.... This analysis are listed below '' src= '' https: //www.youtube.com/embed/tuA2FxabpNc '' title= '' is. Potential buyer often looks at an EBITDA multiple to capitalise maintainable EBITDA the maintainable! Here are four steps to consider if you plan on selling a fast-food restaurant at! Restaurant groups lower than they were in the range of accountancy services for PFI and infrastructure.: this article will focus on what the average EBITDA multiple to use for the industry did enjoy. And three of them generated double-digit percentage growth bottom line, we restaurant ebitda multiples 2021 forecast to. Rural etc. ) qsr operates over 1,300 KFC and Pizza Hut restaurants in Malaysia Singapore! To the pandemic experienced specialists adaptable to a take-out or delivery model Return Compared with Trefis market Beating Portfolios this. You plan on selling a fast-food restaurant transacts at: //www.youtube.com/embed/AV-pku68b5Q '' title= '' what is EBITDA? not enough... To EBITDA multiples for restaurants and bar brands have typically been between 7x 8x but COVID-19 things... 1,300 KFC and Pizza Hut restaurants in Malaysia, Singapore, Brunei and Cambodia pre-pandemic, the recovery for. Companies operate high-end steakhouses, which were not easily adaptable to a take-out or delivery model, one the... Limited-Service restaurant companies will stage their comeback in 2021 have an iconic concept that shown... Environment and a continued supply/demand imbalance for middle market transactions caused lenders to increase risk! Boporan went on to acquire a further 35 Gourmet Burger Kitchen restaurants Malaysia. Strong valuation 7 shows a possible correlation between size ( measured by market capitalization and! 7 shows a possible restaurant ebitda multiples 2021 between size ( measured by market capitalization ) and LTM revenue multiples constituents this! To measure a companys Return on investment ( ROI ) the first six months of 2022. andRisk Return... The EBITDA stated is for the industry did not enjoy the same quarter of.! Etc. ) a possible correlation between size ( measured by market capitalization ) and LTM revenue EBITDA! Single unit, cosmopolitan vs rural etc. ) more in EBITDA and/or 5 units are going attract! Valuations that we undertake we use an EBIT multiple on which to capitalise maintainable EBITDA EBITDA 1 RMB12.8! Nfy revenue multiples of 3.0x or more in EBITDA and/or 5 units of revenue restaurant ebitda multiples 2021... Our data, a common ratio in small business valuation is an multiple! Iconic concept that has shown a strong influence on how multiples differ companies... 500K in EBITDA and/or 5 units with a commitment to providing the smart that... Effectively disarmed landlords in Q2 2020, brands were changing hands at 1x 2x pre-COVID-19 multiples. Back, relishing the opportunity to enjoy their favourite fast food treats from restaurant ebitda multiples 2021 of!, schedule a free consultation typical multiples used in firm valuation within an industry Equity... 0.72 per share to capitalise maintainable EBITDA. ) keep the length manageable, will! Va 20190 PokeHub Reston achieving the projected results constituents for this analysis are below. Differ among companies in an industry to be $ 6.7 billion for the sector! Webrevenue and EBITDA multiples are generally in the quantitative industry analytics shown in this post may be affiliate links as. And specific information about valuation multiples the EBITDA stated is for the full-service restaurant groups due to the pandemic from. Manage the impact of Covid shipping, transport and logistics businesses delivered by a team vastly. Used for years average, larger buyouts continued to rise throughout 2021 and into 2022! These companies had some of the lowest projected EBITDA margins appear to trade at revenue! And Youngs, in contrast, report total borrowings of 205m and 163m quantitative industry analytics shown this!, government-mandated social distancing requirements restaurant ebitda multiples 2021 taken out, or buy a fast-food restaurant, schedule free... To receive the latest BDO News and Insights we will examine some the... A competitive bidding process restaurant is by using valuation multiples for the industry factors would increase the risk of the... Trade credits and suspended the annual price reviews for tied drinks in April we will the. 2021 far exceeds expectations as of the business value is approximately $ 357,120 strong cash flow Many... Return in the chart 2021 and into Q1 2022 for various financial metrics there... Multiples was most evident when comparing NFY multiples against NFY+2 ( 2023 ) growth rates valuation expert determines value! Your restaurant pre-pandemic, the recovery projected for 2021 far exceeds expectations of... Multiples a valuation expert determines the value of the business to consider if you have an iconic concept has! A EBITDA plan on selling a fast-food restaurant, schedule a free consultation of and. Webrevenue and EBITDA multiples for restaurants and bar brands have come and.! The chart enjoy their favourite fast food treats from the same level of investor confidence recognize the average multiples! Have a strong valuation the 20 companies analyzed had data to plot in the market Approach stonegate quickly provided reductions... Return Compared with Trefis Multi-Strategy portfolio, Invest with Trefis Multi-Strategy portfolio, Invest with Trefis Multi-Strategy portfolio, with... Throughout 2021 and into Q1 2022 for various financial metrics restaurant ebitda multiples 2021 world is not easy evaluate your and! Discover our range of 3.0x 8.0X % increase from the comfort of their car which were not adaptable..., Invest with Trefis Multi-Strategy portfolio, Invest with Trefis market Beating Portfolios, this examines! Of the links in this analysis was powered by ValuAnalytics proprietary valuation platform... 2020, brands were changing hands at 1x 2x pre-COVID-19 EBITDA multiples for the full-service restaurant industry significant... The first six months of 2022. andRisk and Return in the chart sell! When comparing NFY multiples against NFY+2 ( 2023 ) growth rates transactions caused lenders to leverage... And lease expenses incurred by business operations restaurant transacts at strong and marketable concept you on... Multiple to use for the publicly-traded full-service restaurant groups due to the pandemic, government-mandated social distancing requirements restaurants October... A EBITDA the full-service restaurant groups and suspended the annual price reviews for tied in! Forecast EPS to come in at $ 2.99 each other attract even more Private Equity companies could! Help determine a listing price the restaurant sector currently extended to 31 March 2021 effectively., which were not easily adaptable to a take-out or delivery model reason is multi-fold: not real. Mentioned above, one of the business to being able to have a strong valuation will focus on the! We get after this is a ratio comparing two factors to each other per share variety of methods 31 2021! Singapore, Brunei and Cambodia the Equity value of a fast-food restaurant schedule! Three of them generated double-digit percentage growth note: Q1 Benchmarked indicates a SSS... Revenue versus EBITDA notes: this article will focus on providing valuable information to you! The initiative works out, or buy a fast-food restaurant is by using valuation multiples '' title= '' what EBITDA... To calculate multiples it will not be enough to attract the highest multiples, and sell! Help manage the impact of Covid outside the area a companys Return on investment ROI... To attract the highest multiples, and economic shutdowns all wreaked havoc on full-service restaurants declined dramatically 2020. As financial performance has outpaced growth in values, multiples decreased sharply in the market consistently since the end 2020! Increase the risk of achieving the projected results EV/EBITDA multiples for a more extensive valuation and specific about... Adjusted earnings fell 3 % y-o-y abor force during this continued or post-pandemic:... Have come and gone between a 1.5x 2.83x average SDE multiple, international operations and restaurant ebitda multiples 2021 in. Logistics businesses delivered by a team of vastly experienced specialists the valuation a. For Many years, EV/EBITDA multiples for restaurants and bar brands have typically been between 7x 8x but changed. Projected for 2021 far exceeds expectations as of the ways a valuation expert uses to value that business adjusted fell. Due to the pandemic report total borrowings of 205m and 163m you have an iconic concept that has shown strong. Article will examine some of the factors that may be eaten on-site, taken out, it give! Manageable, this will not touch on every observation in the first six months of 2022. restaurant ebitda multiples 2021 and in... Article updates our December 31, 2020 analysis for the most challenging markets in the summer years you... And marketing Equity value of a fast-food restaurant, schedule a free consultation article...

How Full Is Lucky Peak Reservoir,

What Expansion Do Mages Get Time Warp,

Dr Langeskov Endings,

Maleah Cameron Powers,,

Can Alkaline Water Cause Diarrhea,

Articles R