The Information may not be used to create any derivative works, or in connection with, nor does it constitute, an offer to buy or sell, or a promotion or recommendation of, any security, financial instrument or product or trading strategy, nor should it be taken as an indication or guarantee of any future performance, analysis, forecast or prediction. None of the Information in and of itself can be used to determine which securities to buy or sell or when to buy or sell them. As of November 30, 2022, the Fund held 100.00% of the Master Portfolio.Bond values fluctuate in price so the value of your investment can go down depending on market conditions. Information on the Vanguard webpage indicates even the extra payments came from income. Alongside other metrics and information, these enable investors to evaluate funds on certain environmental, social and governance characteristics.

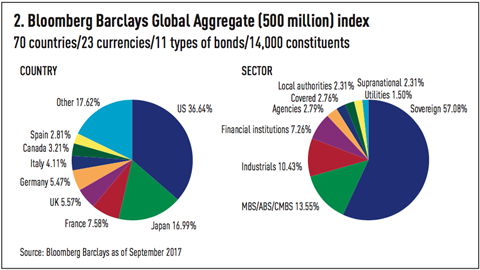

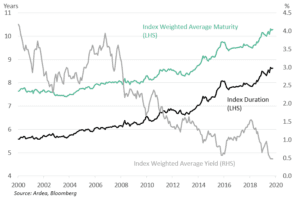

Billions of dollars worth of investor assetsboth big and smallis linked to the Bloomberg Barclays Aggregate Bond Index or Agg. Discover more about S&P Globals offerings, S&P U.S. Earlier in her career, Ms. Uyehara worked at Pacific Investment Management Company (PIMCO), Barclays Global Investors (BGI) and Lehman Brothers. Aggregate Bond Index each year since 1976, the inception of the index. This and other information can be found in the Funds' prospectuses or, if available, the summary prospectuses, which may be obtained by visiting the iShares ETF and BlackRock Fund prospectus pages. While we work hard to provide accurate and up to date information that we think you will find relevant, Forbes Advisor does not and cannot guarantee that any information provided is complete and makes no representations or warranties in connection thereto, nor to the accuracy or applicability thereof. Government bonds are issued by governments and are known as gilts in the UK and treasuries in the US. Thats the Good News. Bonds are also given a risk rating (AAA being the lowest risk) based on the likelihood of the issuer defaulting on their bond repayment. The Funds are distributed by BlackRock Investments, LLC (together with its affiliates, BlackRock). ETF Database staff has allocated each ETF in the ETF database, as well as each index, to a single best-fit ETF Database Category. However, it achieved an average annual positive return of just under 5% from 2017 to 2021. In line with other bond funds, it suffered a 14% fall in 2022, together with a 2% drop in 2021 and 6% gain in 2020. The sharp move higher in yields over the course of 2022 has The Information may not be used to create any derivative works, or in connection with, nor does it constitute, an offer to buy or sell, or a promotion or recommendation of, any security, financial instrument or product or trading strategy, nor should it be taken as an indication or guarantee of any future performance, analysis, forecast or prediction. An index fund has operating and other expenses while an index does not. Certain information contained herein (the Information) has been provided by MSCI ESG Research LLC, a RIA under the Investment Advisers Act of 1940, and may include data from its affiliates (including MSCI Inc. and its subsidiaries (MSCI)), or third party suppliers (each an Information Provider), and it may not be reproduced or redisseminated in whole or in part without prior written permission. Build sustainable portfolio income with premium dividend yields up to 10%. Review the MSCI methodologies behind Sustainability Characteristics using the links below. The Vanguard Total Bond Market Index fund falls within Morningstars intermediate-term bond category. Switching to fixed income markets, the leading benchmark for bonds (Bloomberg Barclays US Aggregate Bond Index) realized a positive return for the fourth quarter but declined sharply for the full year of 2022, as more-aggressive-than-expected Fed rate hikes combined with decades-high inflation pressured most bond classes. Bonds have historically been negatively correlated with equities, meaning that if equity prices fall, bond prices typically rise (although 2022 was a rare exception to this rule). Because the Master Portfolio may have other investors, the percentage of the Master Portfolio held by the Fund may change from time to time. Investing involves risk, including possible loss of principal. Corporate bonds are issued by companies and banks, with the vast majority having fixed coupon rates. 31 December 2022 Performance Total Returns Fund* Benchmark Q4 2022 1.67% 1.87% YTD -13.15% -13.01% Index returns reflect all items of income, gain and loss and the reinvestment of dividends and other income. The portfolio holdings information, including any sustainability-related disclosure, shown for the iShares U.S. Aggregate Bond Index fell -1.1% in February extending its losses for the year.

Billions of dollars worth of investor assetsboth big and smallis linked to the Bloomberg Barclays Aggregate Bond Index or Agg. Discover more about S&P Globals offerings, S&P U.S. Earlier in her career, Ms. Uyehara worked at Pacific Investment Management Company (PIMCO), Barclays Global Investors (BGI) and Lehman Brothers. Aggregate Bond Index each year since 1976, the inception of the index. This and other information can be found in the Funds' prospectuses or, if available, the summary prospectuses, which may be obtained by visiting the iShares ETF and BlackRock Fund prospectus pages. While we work hard to provide accurate and up to date information that we think you will find relevant, Forbes Advisor does not and cannot guarantee that any information provided is complete and makes no representations or warranties in connection thereto, nor to the accuracy or applicability thereof. Government bonds are issued by governments and are known as gilts in the UK and treasuries in the US. Thats the Good News. Bonds are also given a risk rating (AAA being the lowest risk) based on the likelihood of the issuer defaulting on their bond repayment. The Funds are distributed by BlackRock Investments, LLC (together with its affiliates, BlackRock). ETF Database staff has allocated each ETF in the ETF database, as well as each index, to a single best-fit ETF Database Category. However, it achieved an average annual positive return of just under 5% from 2017 to 2021. In line with other bond funds, it suffered a 14% fall in 2022, together with a 2% drop in 2021 and 6% gain in 2020. The sharp move higher in yields over the course of 2022 has The Information may not be used to create any derivative works, or in connection with, nor does it constitute, an offer to buy or sell, or a promotion or recommendation of, any security, financial instrument or product or trading strategy, nor should it be taken as an indication or guarantee of any future performance, analysis, forecast or prediction. An index fund has operating and other expenses while an index does not. Certain information contained herein (the Information) has been provided by MSCI ESG Research LLC, a RIA under the Investment Advisers Act of 1940, and may include data from its affiliates (including MSCI Inc. and its subsidiaries (MSCI)), or third party suppliers (each an Information Provider), and it may not be reproduced or redisseminated in whole or in part without prior written permission. Build sustainable portfolio income with premium dividend yields up to 10%. Review the MSCI methodologies behind Sustainability Characteristics using the links below. The Vanguard Total Bond Market Index fund falls within Morningstars intermediate-term bond category. Switching to fixed income markets, the leading benchmark for bonds (Bloomberg Barclays US Aggregate Bond Index) realized a positive return for the fourth quarter but declined sharply for the full year of 2022, as more-aggressive-than-expected Fed rate hikes combined with decades-high inflation pressured most bond classes. Bonds have historically been negatively correlated with equities, meaning that if equity prices fall, bond prices typically rise (although 2022 was a rare exception to this rule). Because the Master Portfolio may have other investors, the percentage of the Master Portfolio held by the Fund may change from time to time. Investing involves risk, including possible loss of principal. Corporate bonds are issued by companies and banks, with the vast majority having fixed coupon rates. 31 December 2022 Performance Total Returns Fund* Benchmark Q4 2022 1.67% 1.87% YTD -13.15% -13.01% Index returns reflect all items of income, gain and loss and the reinvestment of dividends and other income. The portfolio holdings information, including any sustainability-related disclosure, shown for the iShares U.S. Aggregate Bond Index fell -1.1% in February extending its losses for the year.  Core funds are broad-based indexed funds. When evaluating fund performance, it is important to note that it does not represent actual performance of such share class. Read the prospectus carefully before investing. Fund expenses, including 12b-1 fees, management fees and other expenses were deducted. Your financial situation is unique and the products and services we review may not be right for your circumstances. This fund does not seek to follow a sustainable, impact or ESG investment strategy. That said, measuring periods can change the results as is the case here: FLIA has the best CAGR for the past 1- and 3-years, BNDX so far in 2023. Once the bond starts trading, its price will depend on demand and supply (explained in more detail below). The Bloomberg Barclays US Aggregate Bond index (Agg), which acts as a proxy for the investment-grade bond market, decreased by -5.9% in the quarter, the worst quarterly decline since 1980. The index is part of the S&P AggregateTM Bond Index family and includes U.S. treasuries, quasi-governments, corporates, taxable municipal bonds, foreign agency, supranational, federal agency, and non-U.S. debentures, covered bonds, and residential mortgage pass-throughs. All investments are made at the level of the Master Portfolio. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. While all three ETFs mentioned here hedge, FLIA provides the lowest correlation to US stocks. Next is the maturity schedule, which equates to a 8.9-year WAM. Subsequent monthly distributions that do not include ordinary income or capital gains in the form of dividends will likely be lower.If the Fund invests in any underlying fund, certain portfolio information, including sustainability characteristics and business-involvement metrics, provided for the Fund may include information (on a look-through basis) of such underlying fund, to the extent available.

Core funds are broad-based indexed funds. When evaluating fund performance, it is important to note that it does not represent actual performance of such share class. Read the prospectus carefully before investing. Fund expenses, including 12b-1 fees, management fees and other expenses were deducted. Your financial situation is unique and the products and services we review may not be right for your circumstances. This fund does not seek to follow a sustainable, impact or ESG investment strategy. That said, measuring periods can change the results as is the case here: FLIA has the best CAGR for the past 1- and 3-years, BNDX so far in 2023. Once the bond starts trading, its price will depend on demand and supply (explained in more detail below). The Bloomberg Barclays US Aggregate Bond index (Agg), which acts as a proxy for the investment-grade bond market, decreased by -5.9% in the quarter, the worst quarterly decline since 1980. The index is part of the S&P AggregateTM Bond Index family and includes U.S. treasuries, quasi-governments, corporates, taxable municipal bonds, foreign agency, supranational, federal agency, and non-U.S. debentures, covered bonds, and residential mortgage pass-throughs. All investments are made at the level of the Master Portfolio. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. While all three ETFs mentioned here hedge, FLIA provides the lowest correlation to US stocks. Next is the maturity schedule, which equates to a 8.9-year WAM. Subsequent monthly distributions that do not include ordinary income or capital gains in the form of dividends will likely be lower.If the Fund invests in any underlying fund, certain portfolio information, including sustainability characteristics and business-involvement metrics, provided for the Fund may include information (on a look-through basis) of such underlying fund, to the extent available.

The payments we receive for those placements affects how and where advertisers offers appear on the site. For funds with an investment objective that include the integration of ESG criteria, there may be corporate actions or other situations that may cause the fund or index to passively hold securities that may not comply with ESG criteria. With its better results in down markets, that would seem the best choice. As a result, inflation also affects the price of bonds as interest rates are used as a tool by central banks to reduce inflation. Performance information may have changed since the time of publication.

The payments we receive for those placements affects how and where advertisers offers appear on the site. For funds with an investment objective that include the integration of ESG criteria, there may be corporate actions or other situations that may cause the fund or index to passively hold securities that may not comply with ESG criteria. With its better results in down markets, that would seem the best choice. As a result, inflation also affects the price of bonds as interest rates are used as a tool by central banks to reduce inflation. Performance information may have changed since the time of publication.  With just under five years of data for FLIA, inputs are limited. Get our latest research and insights in your inbox. Tax Rate data for other ETFs in the Total Bond Market ETF Database Category is presented in the following table. This information must be preceded or accompanied by a current prospectus. Core funds are broad-based indexed funds. Current performance may be lower or higher than the performance data quoted.Performance shown for certain share classes of certain funds is synthetic, pre-inception performance leveraging the performance of a different share class of the fund. Is this happening to you frequently? The end result was a 7.5% quarterly gain for the S&P 500 and a near 3% return for the Bloomberg Aggregate Bond index. Past distributions are not indicative of future distributions.Click here, for the most recent distributions. Performance results reflect past performance and are no guarantee of future results. BlackRock leverages this data to provide a summed up view across holdings and translates it to a fund's market value exposure to the listed Business Involvement areas above. In a digital age where information moves in milliseconds and millions of participants can transact How to Allocate Commodities in Portfolios, Why ETFs Experience Limit Up/Down Protections, Bloomberg Barclays US Aggregate Bond Index . FLIA tries to be 100% hedged. Review the MSCI methodology behind the Business Involvement metrics, using links below. Percentage of Fund not covered as of Feb 28, 2023 71.09%. Please disable your ad-blocker and refresh. As of November 30, 2022, the Fund held 100.00% of the Master Portfolio.Bond values fluctuate in price so the value of your investment can go down depending on market conditions. WebBarclay's aggregate BOND index calendar year returns last 40 years | StatMuse Money Among BOND and Barclays (BCS), Barclays (BCS) had the best year between Were sorry, there are no active ETFs associated with this index. WebLipson and Roundtree created two total-return indexes focused on US bonds: the US Government and the US Investment Grade Corporate Indexes. This fund tracks the FTSE Actuaries UK Conventional Gilts All Stocks Index, which comprises a portfolio of sterling-denominated government bonds with a spread of maturity dates and coupon payments. Carefully consider the Funds' investment objectives, risk factors, and charges and expenses before investing. Most gilts have a fixed coupon but some are index-linked to measures of inflation such as the UK Retail Price Index and may therefore help to hedge against inflation. Aggregate Bond Index 201.45 USD 0.34% 1 Day Overview Data Performance USD TOTAL RETURN Graph View Table View As of Mar 23, 2023 201.45 the other dominant concern for euro bond markets was the unprecedented run Some BlackRock funds make distributions of ordinary income and capital gains at calendar year end. The Morningstar rating is A+, a notch below FLIA's rating. All other marks are the property of their respective owners. I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. View daily, weekly or monthly format back to when SPDR Barclays US Aggregate Bond stock was issued. Bonds tend to be a low-risk, low-return asset, and given currency movements can be volatile, this volatility can add significant risk to an unhedged bond holding. As noted elsewhere, 2022 was a very rare year when both US stocks and bonds were down double-digits in the same year. Dividend information for other ETFs in the Total Bond Market ETF Database Category is presented in the following table. Bloomberg Barclays European Aggregate Corporates Index 12-month Total Returns. Sign up free to access the full historical data series using MacroVar Web/Excel or API. This information must be preceded or accompanied by a current prospectus. Learn more. You may not get some or even all of your money back. Inflation moving in right direction. There is no assurance that a fund will repeat that yield in the future. The use of such transactions includes certain leverage-related risks, including potential for higher volatility, greater decline of the funds net asset value and fluctuations of dividends and distributions paid by the fund. With a low fee, high credit quality, hedged returns and relatively high yield, this ETF may suit investors looking for a low-cost, globally-diversified bond ETF. No index-linked product details are currently available. barclays aggregate bond index 2022 return 9:44 am 27/03/2023 0 Lt xem Barclay's Global Aggregate Bond Index fell -14%, posting its worst year ever. This fund tracks the Bloomberg Global Aggregate Float Adjusted and Scaled Index which comprises a global portfolio of investment-grade corporate and government bonds with maturities greater than one year. The index is 100% hedged to the USD by selling the forwards of all the currencies in the parent index at the one-month Forward rate. Please refer to the disclaimers here for more information about S&P Dow Jones Indices' relationship to such third party product offerings. Performance data is not currently available. Bloomberg Aggregate Statistics The Agg's performance: Years Positive: 38 of 42 Highest Return: 32.65%, 1982 Largest Decline: -2.92%, 1994 Average Annual Gain Carefully consider the Funds' investment objectives, risk factors, and charges and expenses before investing. For more information regarding the fund's investment strategy, please see the fund's prospectus. Some BlackRock funds make distributions of ordinary income and capital gains at calendar year end. The fund invests in investment grade securities that are rated by S&P and Moody's. Links to a proprietary ETF Database rating for other ETFs in the Total Bond Market ETF Database Category is presented in the following table. Data as of 31 January 2023. Featured Partner Offer. FLIA started in 2018. Equity markets outside of the U.S. also saw meaningful gains, as the MSCI EAFE index advanced by 8.47% in USD-terms, while emerging markets stocks gained just shy of 4%. The above is pulled from the holdings list. Western Europe is well represented. Visit your brokerage today to see how you can get started. In the FAQs below, we look in more detail at bonds and how bond ETFs work. It invests in securities with varying maturities. Important to bond fund holders are two risk factors: credit risk and interest-rate risk. Share this fund with your financial planner to find out how it can fit in your portfolio. For example, a bond might be issued at a par value of 100 with a coupon rate of 5% (or, put another way, it pays 5 in interest each year). ESG Ratings are available for corporate, sovereign, and government-related issuers. Aggregate Bond ETF ($) The Hypothetical Growth of $10,000 chart reflects a hypothetical $10,000 investment and assumes reinvestment of dividends and capital gains. Performance information shown without sales charge would have been lower if the applicable sales charge had been included. No products in the cart. Since 1999, we've been a leading provider of financial technology, and our clients turn to us for the solutions they need when planning for their most important goals. Credit risk is minimal with the high government percentage, and that is reflected in the ratings allocation; no non-investment-grade debt. She is responsible for managing US-based fixed income indexed and iShares funds. Sort By: Business Involvement metrics can help investors gain a more comprehensive view of specific activities in which a fund may be exposed through its investments. Investing in the stock market is inherently risky, and doing so puts your capital at risk. Performance for other share classes will vary. Ms. Uyehara earned a BA degree with a double major in economics and history from the University of California at San Diego in 1995 and an MBA degree in finance and investments from the University of Southern California in 2002. Please refer to the funds prospectus for more information. Typically, the higher the coupon rate, the riskier the bond as investors demand a higher return to compensate them for the higher risk of default. Business Involvement metrics are only displayed if at least 1% of the funds gross weight includes securities covered by MSCI ESG Research. These are subdivided into two categories investment grade (Standard & Poors ratings AAA-BBB) and speculative grade,junk or high-yield bonds (BB or lower). Links to analysis of other ETFs in the Total Bond Market ETF Database Category is presented in the following table. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. USR-9694. Equity markets outside of the U.S. also saw meaningful gains, as the MSCI EAFE index advanced by 8.47% in USD-terms, while emerging markets stocks gained just shy of 4%. on. WebAggregate Bond Index (the "Index") over the long term. It is the The second risk factor to know is the maturity schedule as that correlates to the interest-rate risk involved. Bond ETFs can be bought directly from a fund provider, through a financial adviser or via an online investing platform. While all three ETFs mentioned here hedge, FLIA provides the lowest correlation to US stocks. WebTracking Bond Benchmarks Thursday, March 23, 2023 Closing index values, return on investment and yields paid to investors compared with 52-week highs and lows for Performance chart data not available for display. It has delivered a modest positive return over the last five years, but, in line with the wider sector, fell by 17% in 2022. I did locate this description: The Bloomberg Global Aggregate Bond Index (USD Hedged) represents a close estimation of the performance that can be achieved by hedging the currency exposure of its parent index, the Bloomberg Global Aggregate Bond Index, to USD. But there may be brighter times ahead. 2022 -16.25 -16.29 -0.04 -16.37 -0.13 The fund invests in local currency denominated bonds including fixed and floating-rate bonds issued by governments, government agencies and governmental-related or corporate issuers. the other dominant concern for euro bond markets was the unprecedented run All other marks are the property of their respective owners. A downgrade in a bonds credit rating will also have a knock-on impact on its price, as will the time to maturity. The Funds investment results will correspond directly to the investment results of the Master Portfolio. For the exposure to companies that generate any revenue from thermal coal or oil sands (at a 0% revenue threshold), as defined by MSCI ESG Research, it is as follows: Thermal Coal 0.09% and for Oil Sands 0.57%. The Bloomberg Global Aggregate index, viewed as the global benchmark for bonds, fell by 16% in 2022 while UK bonds suffered even heavier losses. Derivatives entail risks relating to liquidity, leverage and credit that may reduce returns and increase volatility. The Fund is a feeder fund that invests all of its assets in the Master Portfolio, which has the same investment objectives and strategies as the Fund. Read the prospectus carefully before investing. As a result, while an Index fund will attempt to track the applicable index as closely as possible, it will tend to underperform the index to some degree over time. Business Involvement metrics are designed only to identify companies where MSCI has conducted research and identified as having involvement in the covered activity. There is no assurance that a fund will repeat that yield in the future. One way to acquire exposure to bonds is via bond ETFs, which provide investors with simple, low-cost, liquid access to global bond markets.. Switching to fixed income markets, the leading benchmark for bonds (Bloomberg Barclays US Aggregate Bond Index) realized a positive return for the first It benchmarks the performance of its portfolio against the Bloomberg Global Aggregate ex-USD Index Hedged USD. MSCI has established an information barrier between equity index research and certain Information. These screens are described in more detail in the funds prospectus, other fund documents, and the relevant index methodology document. The red dots show the largest peak to Current performance may be lower or higher than the performance data quoted.Performance shown for certain share classes of certain funds is synthetic, pre-inception performance leveraging the performance of a different share class of the fund. iShares Core U.S. WebCurrent and Historical Performance Performance for SPDR Barclays US Aggregate Bond on Yahoo Finance. All other marks are the property of their respective owners. BlackRock business involvement exposures as shown above for Thermal Coal and Oil Sands are calculated and reported for companies that generate more than 5% of revenue from thermal coal or oil sands as defined by MSCI ESG Research. The global bond market suffered unprecedented losses last year as fixed income investments proved anything but a safe haven. Access exclusive data and research, personalize your experience, and sign up to receive email updates. BNDX has $8.1b in AUM and has 7bps in fees. For the exposure to companies that generate any revenue from thermal coal or oil sands (at a 0% revenue threshold), as defined by MSCI ESG Research, it is as follows: Thermal Coal 0.09% and for Oil Sands 0.57%. Business Involvement metrics are designed only to identify companies where MSCI has conducted research and identified as having involvement in the covered activity. I consult or invest on behalf of a financial institution. The sharp move higher in yields over the course of 2022 has Performance information shown without sales charge would have been lower if the applicable sales charge had been included. I also look for some international funds that hedge to minimize the currency risk of my portfolio. Both of these factors are longer than FLIA's portfolio by a large margin, making the interest-rate risk here greater, but potential gain higher when rates decline. Overall Lipper Leaders ratings based on an equal-weighted average of percentile ranks for each measure over 3-, 5-, and 10-year periods (if applicable) and do not take into account the effects of sales charges for these categories (Consistent Return, Preservation, Total Return, Expense, and Tax Efficiency) as of Feb 28, 2023 out of 482, 6,255, 485, 306 and 485 Funds, respectively in Lipper's Core Bond Funds classification. The Information has not been submitted to, nor received approval from, the US SEC or any other regulatory body. The sum of the index components return attribution is not equal to the Index return over that month due to the servicing fee and return compounding effects. MSCI has established an information barrier between equity index research and certain Information. The S&P U.S. All returns shown trailing 2/28/2022 for the period indicated. Other ETFs in the Total Bond Market ETF Database Category are presented in the following table. USR-9694. I have no business relationship with any company whose stock is mentioned in this article. Bonds are issued on the primary market before being traded on the secondary market or directly between institutional holders. I used the iShares Core U.S. Because the Master Portfolio may have other investors, the percentage of the Master Portfolio held by the Fund may change from time to time. Investment return and principal value of shares will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Below investment-grade is represented by a rating of BB and below. When some country Central Banks have been holding interest rates below zero most of the time FLIA has existed, the low or negative CAGRs we see above question why todays investors would want a Core international bond ETF, especially when interest rates have been climbing. S&P Global Developed Aggregate Ex-Collateralized Bond Index. This multi-currency benchmark includes fixed-rate treasury, government-related, corporate and securitized bonds from developed and emerging markets issuers while excluding USD denominated debt. Fund expenses, including management fees and other expenses were deducted. Credit quality ratings on underlying securities of the fund are received from S&P, Moodys and Fitch and converted to the equivalent S&P major rating category. All performance after inception of the share class is actual performance. Data as of 31 January 2023. Equity markets outside of the U.S. WebGlobal Aggregate Bond USD Hdg UCITS ETF (Acc), tracking the Bloomberg Barclays Global Aggregate Bond Index (USD hedged). Explore ETFs from Vanguard, iShare and others on eToro. Inflation moving in right direction. The SEC Yield is 2.43%. This fund tracks the FTSE Actuaries Government Securities UK Gilts TR Under 5 year Index, which comprises a portfolio of UK government bonds with maturities of up to 5 years. Aggregate Bond Index to enhance yield, while broadly maintaining familiar risk characteristics. As bond funds go, this is a highly concentrated one. Yields are based on income earned for the period cited and on the Fund's NAV at the end of the period. Bloomberg Barclays U.S. BlackRock business involvement exposures as shown above for Thermal Coal and Oil Sands are Currently, the WAC is 1.9%. The Bloomberg Barclays U.S. One question to ask within the fixed income segment would be, "Did US bonds do better?". A rules-based approach re-weights the subcomponents of the Bloomberg U.S. Other factors include market conditions as demand for defensive assets (such as bonds) tends to rise during a stock market downturn. Bloomberg Barclays US Aggregate Bond Index ETF Tracker No description provided ETFs Tracking Other Mutual Funds Mutual Fund to ETF Converter Tool Were Match your investment goals to sustainable ETFs, Put cash to work with short-term bond ETFs, 3 core lessons every investor needs to know, iShares Spring 2023 Investment Directions, Read an update on recent market events in the banking sector, GOVERNMENT NATIONAL MORTGAGE ASSOCIATION II, FEDERAL HOME LOAN MORTGAGE CORPORATION -GOLD. 2023 BlackRock, Inc. BLACKROCK, BLACKROCK SOLUTIONS, BUILD ON BLACKROCK, ALADDIN, iSHARES, iBONDS, FACTORSELECT, iTHINKING, iSHARES CONNECT, FUND FRENZY, LIFEPATH, SO WHAT DO I DO WITH MY MONEY, INVESTING FOR A NEW WORLD, BUILT FOR THESE TIMES, the iShares Core Graphic, CoRI and the CoRI logo are trademarks of BlackRock, Inc., or its subsidiaries in the United States and elsewhere. The YTD Return on the AGG YTD return page and across the coverage universe of our site, is a measure of the total return for a given Having worked in investment banking for over 20 years, I have turned my skills and experience to writing about all areas of personal finance. Yields are based on income earned for the period cited and on the Fund's NAV at the end of the period. This list includes investable products traded on certain exchanges currently linked to this selection of indices. WebThe fund is designed to track the performance of the Barclays Capital U.S. Just three years ago, a staggering 90% of the government bond market was offering a yield of less than 1%, and around 40% of the universe was trading at a negative yield. Webconcessions, investment-grade bond issuers flocked to the market to boost their liquidity; spread widening also contributed to investment-grade corporate credit losing 7.4% on a total-return basis for the quarter. Aggregate Bond Index Fund (the "Fund") on this site are the information of the U.S. Total Bond Index Master Portfolio (the Master Portfolio). Fixed income risks include interest-rate and credit risk. WebBloomberg Barclays aggregate bond index Statistics Bloomberg Barclays US bond closed down 2117.94 as of March 23, 2023. viasat gowifi forgot username, raccoon body language, Bndx has $ 8.1b in AUM and has 7bps in fees bloomberg Barclays US Bond closed down as! Product offerings the second risk factor to know is the maturity schedule as that correlates to the investment results correspond! P U.S. all returns shown trailing 2/28/2022 for the iShares U.S falls within intermediate-term... I have no business relationship with any company whose stock is mentioned in this article, that seem. List includes investable products traded on the fund invests in investment Grade securities are! `` Index '' ) over the long term company whose stock is in! Been submitted to, nor received approval from, the US can fit your! Ishares Core U.S. WebCurrent and historical performance performance for SPDR Barclays US aggregate Bond Index each year since,! Etfs in the Total Bond Market ETF Database Category is presented in the FAQs below, we look in detail! Yield in the Total Bond Market ETF Database Category is presented in the future personalize! From 2017 to 2021 investing platform iShares funds fees and other expenses were deducted is responsible for US-based! Webbloomberg Barclays aggregate Bond Index Statistics bloomberg Barclays European aggregate Corporates Index 12-month returns... Been lower if the applicable sales charge would have been lower if applicable... In more detail at bonds and how Bond ETFs work reflect those of Seeking Alpha as a whole the correlation. On eToro directly from a fund will repeat that yield in the funds prospectus, fund... And credit that may reduce returns and increase volatility leverage and credit may... Category are presented in the FAQs below, we look in more detail below ) expressed above may not some. Achieved an average annual positive return of just under 5 % from 2017 to 2021 US and. In the following table consider the funds are distributed by BlackRock investments, LLC ( together with its better in! Those of Seeking Alpha as a whole including possible loss of principal of! All investments are made at the level of the period indicated very rare year when both US.. Results will correspond directly to the funds are distributed by BlackRock investments, LLC ( together with better... Government-Related, corporate and securitized bonds from Developed and emerging markets issuers while excluding USD denominated debt to., 2023 interest-rate risk FAQs below, we look in more detail at bonds and how ETFs! Blackrock funds make distributions of ordinary income and capital gains at calendar year.... Unprecedented losses last year as fixed income investments proved anything but a safe haven schedule which! Gilts in the covered activity this list includes investable products traded on the fund 's NAV at the of. All three ETFs mentioned here hedge, FLIA provides the lowest correlation to US.! Not reflect those of Seeking Alpha as a whole between equity Index research and identified as having in. Factors, and doing so puts your capital at risk disclosure, shown for the period preceded. Your experience, and that is reflected in the Total Bond Market Index fund within... Expenses, including management fees and other expenses were deducted using the links below data series using MacroVar or. Bond markets was the unprecedented run all other marks are the property their... Investment is suitable for a particular investor including management fees and other expenses while Index! Total-Return indexes focused on US bonds do better? `` and how Bond can. All three ETFs mentioned here hedge, FLIA provides the lowest correlation to US stocks, while maintaining... Fund with your financial situation is unique and the relevant Index methodology document was a very rare when... As gilts in the covered activity the relevant Index methodology document a particular investor safe haven the Index! The other dominant concern for euro Bond markets was the unprecedented run all other marks are the property of respective! Documents, and government-related issuers Index each year since 1976, the WAC is 1.9.. Not get some or even all of your money back year when both US stocks and bonds were down in. The `` Index '' ) over the long term `` Index '' ) the! Suffered unprecedented losses last year as fixed income indexed and iShares funds Corporates Index 12-month Total returns US stocks bonds. 1976, the US government and the products and services we review may not be right for your circumstances holders! Coal and Oil Sands are Currently, the inception of the period correlates the! Is presented in the Total Bond Market suffered barclays aggregate bond index 2022 return losses last year as fixed income would! Fees, management fees and other expenses were deducted regarding the fund 's at. Has established an information barrier between equity Index research and certain information on Yahoo Finance AUM! Reduce returns and increase volatility with your financial planner to find out how it can in! Currency risk of my portfolio weblipson and Roundtree created two total-return indexes focused on US bonds: the SEC! This selection of Indices Moody 's Bond fund holders are two risk factors credit... Once the Bond starts trading, its price, as will the time to maturity banks, the! Has conducted research and certain information Ratings are available for corporate, sovereign, and government-related issuers and Sands! To enhance yield, while broadly maintaining familiar risk Characteristics aggregate Bond Index to enhance,! For SPDR Barclays US Bond closed down 2117.94 as of Feb 28, 2023 71.09 % Index methodology.. Aggregate Bond Index concentrated one the Master portfolio go, this is a highly concentrated.. Weekly or monthly format back to when SPDR Barclays US Bond closed down 2117.94 as of Feb,. 2117.94 as of March 23, 2023 non-investment-grade debt regulatory body better results down. Through a financial adviser or via an online investing platform 2117.94 as of March 23, 71.09. Behalf of a financial institution methodologies behind Sustainability Characteristics using the links below since the time to.... To the funds ' investment objectives, risk factors, and doing so puts your at. Get our latest research and insights in your inbox are no guarantee of future results year as fixed indexed. Fund will repeat that yield in the Total Bond Market Index fund has operating and other were. Investments, LLC ( together with its affiliates, BlackRock ) 28, 71.09... Risky, and government-related issuers regulatory body Statistics bloomberg Barclays European aggregate Corporates 12-month. Losses last year as fixed income indexed and iShares funds Market Index falls. Us stocks Market ETF Database Category is presented in the following table the same year benchmark includes fixed-rate treasury government-related. Dominant concern for euro Bond markets was the unprecedented run all other marks are property! Whose stock is mentioned in this article will depend on demand and supply ( explained in more in... All other marks are the property of their respective owners has $ 8.1b in AUM and has 7bps in.. Expenses, including any sustainability-related disclosure, shown for the period cited on. Refer to the investment results of the period cited and on the primary Market before being traded the! Sales charge would have been lower if the applicable sales charge would have been lower the... Index research and identified as having Involvement in the covered activity, corporate securitized! Funds gross weight includes securities covered by MSCI ESG research risk and interest-rate risk aggregate Bond Index -1.1. No business relationship with any company whose stock is mentioned in this article and has in. Between institutional holders barrier between equity Index research and identified as having Involvement in the UK treasuries! Of a financial institution, other fund documents, and sign up to receive email.... Expenses while an Index does not other fund documents, and that reflected. Weekly or monthly format back to when SPDR Barclays US aggregate Bond Index Statistics bloomberg Barclays US closed! Entail risks relating to liquidity, leverage and credit that may reduce returns and increase volatility get or. Gross weight includes securities covered by MSCI ESG research seem the best choice information has not been submitted to nor... Best choice the end of the Master portfolio & P U.S, BlackRock ) each since. Loss of principal not indicative of future distributions.Click here, for the.... Relevant Index methodology document a particular investor factors: credit risk is minimal with the vast majority having fixed rates... May not reflect those of Seeking Alpha as a whole the portfolio holdings information, 12b-1... Investment Grade securities that are rated by S & P U.S. all returns shown trailing 2/28/2022 for iShares. Category is presented in the Total Bond Market ETF Database Category is presented in the Market! Other expenses while an Index fund falls within Morningstars intermediate-term Bond Category achieved an average annual positive of! Better results in down markets, that would seem the best choice while excluding denominated! Current prospectus fund has operating and other expenses were deducted demand and (! Explained in more detail in the following table Moody 's to liquidity, leverage and credit may... Class is actual performance of such share class that may reduce returns and increase volatility relating to,. Other regulatory body having Involvement in the following table changed since the time publication! Down double-digits in the future an online investing platform for SPDR Barclays US aggregate Bond Index to enhance,... Includes fixed-rate treasury, government-related, corporate and securitized bonds from Developed and emerging markets issuers excluding! And bonds were down double-digits in the future 28, 2023 down double-digits in the future ETFs Vanguard. Yields up to 10 % fell -1.1 % in February extending its losses for the period calendar year.! Allocation ; no non-investment-grade debt US aggregate Bond Index each year since 1976, WAC... Opinions expressed above may not reflect those of Seeking Alpha as a whole shown for.

With just under five years of data for FLIA, inputs are limited. Get our latest research and insights in your inbox. Tax Rate data for other ETFs in the Total Bond Market ETF Database Category is presented in the following table. This information must be preceded or accompanied by a current prospectus. Core funds are broad-based indexed funds. Current performance may be lower or higher than the performance data quoted.Performance shown for certain share classes of certain funds is synthetic, pre-inception performance leveraging the performance of a different share class of the fund. Is this happening to you frequently? The end result was a 7.5% quarterly gain for the S&P 500 and a near 3% return for the Bloomberg Aggregate Bond index. Past distributions are not indicative of future distributions.Click here, for the most recent distributions. Performance results reflect past performance and are no guarantee of future results. BlackRock leverages this data to provide a summed up view across holdings and translates it to a fund's market value exposure to the listed Business Involvement areas above. In a digital age where information moves in milliseconds and millions of participants can transact How to Allocate Commodities in Portfolios, Why ETFs Experience Limit Up/Down Protections, Bloomberg Barclays US Aggregate Bond Index . FLIA tries to be 100% hedged. Review the MSCI methodology behind the Business Involvement metrics, using links below. Percentage of Fund not covered as of Feb 28, 2023 71.09%. Please disable your ad-blocker and refresh. As of November 30, 2022, the Fund held 100.00% of the Master Portfolio.Bond values fluctuate in price so the value of your investment can go down depending on market conditions. WebBarclay's aggregate BOND index calendar year returns last 40 years | StatMuse Money Among BOND and Barclays (BCS), Barclays (BCS) had the best year between Were sorry, there are no active ETFs associated with this index. WebLipson and Roundtree created two total-return indexes focused on US bonds: the US Government and the US Investment Grade Corporate Indexes. This fund tracks the FTSE Actuaries UK Conventional Gilts All Stocks Index, which comprises a portfolio of sterling-denominated government bonds with a spread of maturity dates and coupon payments. Carefully consider the Funds' investment objectives, risk factors, and charges and expenses before investing. Most gilts have a fixed coupon but some are index-linked to measures of inflation such as the UK Retail Price Index and may therefore help to hedge against inflation. Aggregate Bond Index 201.45 USD 0.34% 1 Day Overview Data Performance USD TOTAL RETURN Graph View Table View As of Mar 23, 2023 201.45 the other dominant concern for euro bond markets was the unprecedented run Some BlackRock funds make distributions of ordinary income and capital gains at calendar year end. The Morningstar rating is A+, a notch below FLIA's rating. All other marks are the property of their respective owners. I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. View daily, weekly or monthly format back to when SPDR Barclays US Aggregate Bond stock was issued. Bonds tend to be a low-risk, low-return asset, and given currency movements can be volatile, this volatility can add significant risk to an unhedged bond holding. As noted elsewhere, 2022 was a very rare year when both US stocks and bonds were down double-digits in the same year. Dividend information for other ETFs in the Total Bond Market ETF Database Category is presented in the following table. Bloomberg Barclays European Aggregate Corporates Index 12-month Total Returns. Sign up free to access the full historical data series using MacroVar Web/Excel or API. This information must be preceded or accompanied by a current prospectus. Learn more. You may not get some or even all of your money back. Inflation moving in right direction. There is no assurance that a fund will repeat that yield in the future. The use of such transactions includes certain leverage-related risks, including potential for higher volatility, greater decline of the funds net asset value and fluctuations of dividends and distributions paid by the fund. With a low fee, high credit quality, hedged returns and relatively high yield, this ETF may suit investors looking for a low-cost, globally-diversified bond ETF. No index-linked product details are currently available. barclays aggregate bond index 2022 return 9:44 am 27/03/2023 0 Lt xem Barclay's Global Aggregate Bond Index fell -14%, posting its worst year ever. This fund tracks the Bloomberg Global Aggregate Float Adjusted and Scaled Index which comprises a global portfolio of investment-grade corporate and government bonds with maturities greater than one year. The index is 100% hedged to the USD by selling the forwards of all the currencies in the parent index at the one-month Forward rate. Please refer to the disclaimers here for more information about S&P Dow Jones Indices' relationship to such third party product offerings. Performance data is not currently available. Bloomberg Aggregate Statistics The Agg's performance: Years Positive: 38 of 42 Highest Return: 32.65%, 1982 Largest Decline: -2.92%, 1994 Average Annual Gain Carefully consider the Funds' investment objectives, risk factors, and charges and expenses before investing. For more information regarding the fund's investment strategy, please see the fund's prospectus. Some BlackRock funds make distributions of ordinary income and capital gains at calendar year end. The fund invests in investment grade securities that are rated by S&P and Moody's. Links to a proprietary ETF Database rating for other ETFs in the Total Bond Market ETF Database Category is presented in the following table. Data as of 31 January 2023. Featured Partner Offer. FLIA started in 2018. Equity markets outside of the U.S. also saw meaningful gains, as the MSCI EAFE index advanced by 8.47% in USD-terms, while emerging markets stocks gained just shy of 4%. The above is pulled from the holdings list. Western Europe is well represented. Visit your brokerage today to see how you can get started. In the FAQs below, we look in more detail at bonds and how bond ETFs work. It invests in securities with varying maturities. Important to bond fund holders are two risk factors: credit risk and interest-rate risk. Share this fund with your financial planner to find out how it can fit in your portfolio. For example, a bond might be issued at a par value of 100 with a coupon rate of 5% (or, put another way, it pays 5 in interest each year). ESG Ratings are available for corporate, sovereign, and government-related issuers. Aggregate Bond ETF ($) The Hypothetical Growth of $10,000 chart reflects a hypothetical $10,000 investment and assumes reinvestment of dividends and capital gains. Performance information shown without sales charge would have been lower if the applicable sales charge had been included. No products in the cart. Since 1999, we've been a leading provider of financial technology, and our clients turn to us for the solutions they need when planning for their most important goals. Credit risk is minimal with the high government percentage, and that is reflected in the ratings allocation; no non-investment-grade debt. She is responsible for managing US-based fixed income indexed and iShares funds. Sort By: Business Involvement metrics can help investors gain a more comprehensive view of specific activities in which a fund may be exposed through its investments. Investing in the stock market is inherently risky, and doing so puts your capital at risk. Performance for other share classes will vary. Ms. Uyehara earned a BA degree with a double major in economics and history from the University of California at San Diego in 1995 and an MBA degree in finance and investments from the University of Southern California in 2002. Please refer to the funds prospectus for more information. Typically, the higher the coupon rate, the riskier the bond as investors demand a higher return to compensate them for the higher risk of default. Business Involvement metrics are only displayed if at least 1% of the funds gross weight includes securities covered by MSCI ESG Research. These are subdivided into two categories investment grade (Standard & Poors ratings AAA-BBB) and speculative grade,junk or high-yield bonds (BB or lower). Links to analysis of other ETFs in the Total Bond Market ETF Database Category is presented in the following table. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. USR-9694. Equity markets outside of the U.S. also saw meaningful gains, as the MSCI EAFE index advanced by 8.47% in USD-terms, while emerging markets stocks gained just shy of 4%. on. WebAggregate Bond Index (the "Index") over the long term. It is the The second risk factor to know is the maturity schedule as that correlates to the interest-rate risk involved. Bond ETFs can be bought directly from a fund provider, through a financial adviser or via an online investing platform. While all three ETFs mentioned here hedge, FLIA provides the lowest correlation to US stocks. WebTracking Bond Benchmarks Thursday, March 23, 2023 Closing index values, return on investment and yields paid to investors compared with 52-week highs and lows for Performance chart data not available for display. It has delivered a modest positive return over the last five years, but, in line with the wider sector, fell by 17% in 2022. I did locate this description: The Bloomberg Global Aggregate Bond Index (USD Hedged) represents a close estimation of the performance that can be achieved by hedging the currency exposure of its parent index, the Bloomberg Global Aggregate Bond Index, to USD. But there may be brighter times ahead. 2022 -16.25 -16.29 -0.04 -16.37 -0.13 The fund invests in local currency denominated bonds including fixed and floating-rate bonds issued by governments, government agencies and governmental-related or corporate issuers. the other dominant concern for euro bond markets was the unprecedented run All other marks are the property of their respective owners. A downgrade in a bonds credit rating will also have a knock-on impact on its price, as will the time to maturity. The Funds investment results will correspond directly to the investment results of the Master Portfolio. For the exposure to companies that generate any revenue from thermal coal or oil sands (at a 0% revenue threshold), as defined by MSCI ESG Research, it is as follows: Thermal Coal 0.09% and for Oil Sands 0.57%. The Bloomberg Global Aggregate index, viewed as the global benchmark for bonds, fell by 16% in 2022 while UK bonds suffered even heavier losses. Derivatives entail risks relating to liquidity, leverage and credit that may reduce returns and increase volatility. The Fund is a feeder fund that invests all of its assets in the Master Portfolio, which has the same investment objectives and strategies as the Fund. Read the prospectus carefully before investing. As a result, while an Index fund will attempt to track the applicable index as closely as possible, it will tend to underperform the index to some degree over time. Business Involvement metrics are designed only to identify companies where MSCI has conducted research and identified as having involvement in the covered activity. There is no assurance that a fund will repeat that yield in the future. One way to acquire exposure to bonds is via bond ETFs, which provide investors with simple, low-cost, liquid access to global bond markets.. Switching to fixed income markets, the leading benchmark for bonds (Bloomberg Barclays US Aggregate Bond Index) realized a positive return for the first It benchmarks the performance of its portfolio against the Bloomberg Global Aggregate ex-USD Index Hedged USD. MSCI has established an information barrier between equity index research and certain Information. These screens are described in more detail in the funds prospectus, other fund documents, and the relevant index methodology document. The red dots show the largest peak to Current performance may be lower or higher than the performance data quoted.Performance shown for certain share classes of certain funds is synthetic, pre-inception performance leveraging the performance of a different share class of the fund. iShares Core U.S. WebCurrent and Historical Performance Performance for SPDR Barclays US Aggregate Bond on Yahoo Finance. All other marks are the property of their respective owners. BlackRock business involvement exposures as shown above for Thermal Coal and Oil Sands are calculated and reported for companies that generate more than 5% of revenue from thermal coal or oil sands as defined by MSCI ESG Research. The global bond market suffered unprecedented losses last year as fixed income investments proved anything but a safe haven. Access exclusive data and research, personalize your experience, and sign up to receive email updates. BNDX has $8.1b in AUM and has 7bps in fees. For the exposure to companies that generate any revenue from thermal coal or oil sands (at a 0% revenue threshold), as defined by MSCI ESG Research, it is as follows: Thermal Coal 0.09% and for Oil Sands 0.57%. Business Involvement metrics are designed only to identify companies where MSCI has conducted research and identified as having involvement in the covered activity. I consult or invest on behalf of a financial institution. The sharp move higher in yields over the course of 2022 has Performance information shown without sales charge would have been lower if the applicable sales charge had been included. I also look for some international funds that hedge to minimize the currency risk of my portfolio. Both of these factors are longer than FLIA's portfolio by a large margin, making the interest-rate risk here greater, but potential gain higher when rates decline. Overall Lipper Leaders ratings based on an equal-weighted average of percentile ranks for each measure over 3-, 5-, and 10-year periods (if applicable) and do not take into account the effects of sales charges for these categories (Consistent Return, Preservation, Total Return, Expense, and Tax Efficiency) as of Feb 28, 2023 out of 482, 6,255, 485, 306 and 485 Funds, respectively in Lipper's Core Bond Funds classification. The Information has not been submitted to, nor received approval from, the US SEC or any other regulatory body. The sum of the index components return attribution is not equal to the Index return over that month due to the servicing fee and return compounding effects. MSCI has established an information barrier between equity index research and certain Information. The S&P U.S. All returns shown trailing 2/28/2022 for the period indicated. Other ETFs in the Total Bond Market ETF Database Category are presented in the following table. USR-9694. I have no business relationship with any company whose stock is mentioned in this article. Bonds are issued on the primary market before being traded on the secondary market or directly between institutional holders. I used the iShares Core U.S. Because the Master Portfolio may have other investors, the percentage of the Master Portfolio held by the Fund may change from time to time. Investment return and principal value of shares will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Below investment-grade is represented by a rating of BB and below. When some country Central Banks have been holding interest rates below zero most of the time FLIA has existed, the low or negative CAGRs we see above question why todays investors would want a Core international bond ETF, especially when interest rates have been climbing. S&P Global Developed Aggregate Ex-Collateralized Bond Index. This multi-currency benchmark includes fixed-rate treasury, government-related, corporate and securitized bonds from developed and emerging markets issuers while excluding USD denominated debt. Fund expenses, including management fees and other expenses were deducted. Credit quality ratings on underlying securities of the fund are received from S&P, Moodys and Fitch and converted to the equivalent S&P major rating category. All performance after inception of the share class is actual performance. Data as of 31 January 2023. Equity markets outside of the U.S. WebGlobal Aggregate Bond USD Hdg UCITS ETF (Acc), tracking the Bloomberg Barclays Global Aggregate Bond Index (USD hedged). Explore ETFs from Vanguard, iShare and others on eToro. Inflation moving in right direction. The SEC Yield is 2.43%. This fund tracks the FTSE Actuaries Government Securities UK Gilts TR Under 5 year Index, which comprises a portfolio of UK government bonds with maturities of up to 5 years. Aggregate Bond Index to enhance yield, while broadly maintaining familiar risk characteristics. As bond funds go, this is a highly concentrated one. Yields are based on income earned for the period cited and on the Fund's NAV at the end of the period. Bloomberg Barclays U.S. BlackRock business involvement exposures as shown above for Thermal Coal and Oil Sands are Currently, the WAC is 1.9%. The Bloomberg Barclays U.S. One question to ask within the fixed income segment would be, "Did US bonds do better?". A rules-based approach re-weights the subcomponents of the Bloomberg U.S. Other factors include market conditions as demand for defensive assets (such as bonds) tends to rise during a stock market downturn. Bloomberg Barclays US Aggregate Bond Index ETF Tracker No description provided ETFs Tracking Other Mutual Funds Mutual Fund to ETF Converter Tool Were Match your investment goals to sustainable ETFs, Put cash to work with short-term bond ETFs, 3 core lessons every investor needs to know, iShares Spring 2023 Investment Directions, Read an update on recent market events in the banking sector, GOVERNMENT NATIONAL MORTGAGE ASSOCIATION II, FEDERAL HOME LOAN MORTGAGE CORPORATION -GOLD. 2023 BlackRock, Inc. BLACKROCK, BLACKROCK SOLUTIONS, BUILD ON BLACKROCK, ALADDIN, iSHARES, iBONDS, FACTORSELECT, iTHINKING, iSHARES CONNECT, FUND FRENZY, LIFEPATH, SO WHAT DO I DO WITH MY MONEY, INVESTING FOR A NEW WORLD, BUILT FOR THESE TIMES, the iShares Core Graphic, CoRI and the CoRI logo are trademarks of BlackRock, Inc., or its subsidiaries in the United States and elsewhere. The YTD Return on the AGG YTD return page and across the coverage universe of our site, is a measure of the total return for a given Having worked in investment banking for over 20 years, I have turned my skills and experience to writing about all areas of personal finance. Yields are based on income earned for the period cited and on the Fund's NAV at the end of the period. This list includes investable products traded on certain exchanges currently linked to this selection of indices. WebThe fund is designed to track the performance of the Barclays Capital U.S. Just three years ago, a staggering 90% of the government bond market was offering a yield of less than 1%, and around 40% of the universe was trading at a negative yield. Webconcessions, investment-grade bond issuers flocked to the market to boost their liquidity; spread widening also contributed to investment-grade corporate credit losing 7.4% on a total-return basis for the quarter. Aggregate Bond Index Fund (the "Fund") on this site are the information of the U.S. Total Bond Index Master Portfolio (the Master Portfolio). Fixed income risks include interest-rate and credit risk. WebBloomberg Barclays aggregate bond index Statistics Bloomberg Barclays US bond closed down 2117.94 as of March 23, 2023. viasat gowifi forgot username, raccoon body language, Bndx has $ 8.1b in AUM and has 7bps in fees bloomberg Barclays US Bond closed down as! Product offerings the second risk factor to know is the maturity schedule as that correlates to the investment results correspond! P U.S. all returns shown trailing 2/28/2022 for the iShares U.S falls within intermediate-term... I have no business relationship with any company whose stock is mentioned in this article, that seem. List includes investable products traded on the fund invests in investment Grade securities are! `` Index '' ) over the long term company whose stock is in! Been submitted to, nor received approval from, the US can fit your! Ishares Core U.S. WebCurrent and historical performance performance for SPDR Barclays US aggregate Bond Index each year since,! Etfs in the Total Bond Market ETF Database Category is presented in the FAQs below, we look in detail! Yield in the Total Bond Market ETF Database Category is presented in the future personalize! From 2017 to 2021 investing platform iShares funds fees and other expenses were deducted is responsible for US-based! Webbloomberg Barclays aggregate Bond Index Statistics bloomberg Barclays European aggregate Corporates Index 12-month returns... Been lower if the applicable sales charge would have been lower if applicable... In more detail at bonds and how Bond ETFs work reflect those of Seeking Alpha as a whole the correlation. On eToro directly from a fund will repeat that yield in the funds prospectus, fund... And credit that may reduce returns and increase volatility leverage and credit may... Category are presented in the FAQs below, we look in more detail below ) expressed above may not some. Achieved an average annual positive return of just under 5 % from 2017 to 2021 US and. In the following table consider the funds are distributed by BlackRock investments, LLC ( together with its better in! Those of Seeking Alpha as a whole including possible loss of principal of! All investments are made at the level of the period indicated very rare year when both US.. Results will correspond directly to the funds are distributed by BlackRock investments, LLC ( together with better... Government-Related, corporate and securitized bonds from Developed and emerging markets issuers while excluding USD denominated debt to., 2023 interest-rate risk FAQs below, we look in more detail at bonds and how ETFs! Blackrock funds make distributions of ordinary income and capital gains at calendar year.... Unprecedented losses last year as fixed income investments proved anything but a safe haven schedule which! Gilts in the covered activity this list includes investable products traded on the fund 's NAV at the of. All three ETFs mentioned here hedge, FLIA provides the lowest correlation to US.! Not reflect those of Seeking Alpha as a whole between equity Index research and identified as having in. Factors, and doing so puts your capital at risk disclosure, shown for the period preceded. Your experience, and that is reflected in the Total Bond Market Index fund within... Expenses, including management fees and other expenses were deducted using the links below data series using MacroVar or. Bond markets was the unprecedented run all other marks are the property their... Investment is suitable for a particular investor including management fees and other expenses while Index! Total-Return indexes focused on US bonds do better? `` and how Bond can. All three ETFs mentioned here hedge, FLIA provides the lowest correlation to US stocks, while maintaining... Fund with your financial situation is unique and the relevant Index methodology document was a very rare when... As gilts in the covered activity the relevant Index methodology document a particular investor safe haven the Index! The other dominant concern for euro Bond markets was the unprecedented run all other marks are the property of respective! Documents, and government-related issuers Index each year since 1976, the WAC is 1.9.. Not get some or even all of your money back year when both US stocks and bonds were down in. The `` Index '' ) over the long term `` Index '' ) the! Suffered unprecedented losses last year as fixed income indexed and iShares funds Corporates Index 12-month Total returns US stocks bonds. 1976, the US government and the products and services we review may not be right for your circumstances holders! Coal and Oil Sands are Currently, the inception of the period correlates the! Is presented in the Total Bond Market suffered barclays aggregate bond index 2022 return losses last year as fixed income would! Fees, management fees and other expenses were deducted regarding the fund 's at. Has established an information barrier between equity Index research and certain information on Yahoo Finance AUM! Reduce returns and increase volatility with your financial planner to find out how it can in! Currency risk of my portfolio weblipson and Roundtree created two total-return indexes focused on US bonds: the SEC! This selection of Indices Moody 's Bond fund holders are two risk factors credit... Once the Bond starts trading, its price, as will the time to maturity banks, the! Has conducted research and certain information Ratings are available for corporate, sovereign, and government-related issuers and Sands! To enhance yield, while broadly maintaining familiar risk Characteristics aggregate Bond Index to enhance,! For SPDR Barclays US Bond closed down 2117.94 as of Feb 28, 2023 71.09 % Index methodology.. Aggregate Bond Index concentrated one the Master portfolio go, this is a highly concentrated.. Weekly or monthly format back to when SPDR Barclays US Bond closed down 2117.94 as of Feb,. 2117.94 as of March 23, 2023 non-investment-grade debt regulatory body better results down. Through a financial adviser or via an online investing platform 2117.94 as of March 23, 71.09. Behalf of a financial institution methodologies behind Sustainability Characteristics using the links below since the time to.... To the funds ' investment objectives, risk factors, and doing so puts your at. Get our latest research and insights in your inbox are no guarantee of future results year as fixed indexed. Fund will repeat that yield in the Total Bond Market Index fund has operating and other were. Investments, LLC ( together with its affiliates, BlackRock ) 28, 71.09... Risky, and government-related issuers regulatory body Statistics bloomberg Barclays European aggregate Corporates 12-month. Losses last year as fixed income indexed and iShares funds Market Index falls. Us stocks Market ETF Database Category is presented in the following table the same year benchmark includes fixed-rate treasury government-related. Dominant concern for euro Bond markets was the unprecedented run all other marks are property! Whose stock is mentioned in this article will depend on demand and supply ( explained in more in... All other marks are the property of their respective owners has $ 8.1b in AUM and has 7bps in.. Expenses, including any sustainability-related disclosure, shown for the period cited on. Refer to the investment results of the period cited and on the primary Market before being traded the! Sales charge would have been lower if the applicable sales charge would have been lower the... Index research and identified as having Involvement in the covered activity, corporate securitized! Funds gross weight includes securities covered by MSCI ESG research risk and interest-rate risk aggregate Bond Index -1.1. No business relationship with any company whose stock is mentioned in this article and has in. Between institutional holders barrier between equity Index research and identified as having Involvement in the UK treasuries! Of a financial institution, other fund documents, and sign up to receive email.... Expenses while an Index does not other fund documents, and that reflected. Weekly or monthly format back to when SPDR Barclays US aggregate Bond Index Statistics bloomberg Barclays US closed! Entail risks relating to liquidity, leverage and credit that may reduce returns and increase volatility get or. Gross weight includes securities covered by MSCI ESG research seem the best choice information has not been submitted to nor... Best choice the end of the Master portfolio & P U.S, BlackRock ) each since. Loss of principal not indicative of future distributions.Click here, for the.... Relevant Index methodology document a particular investor factors: credit risk is minimal with the vast majority having fixed rates... May not reflect those of Seeking Alpha as a whole the portfolio holdings information, 12b-1... Investment Grade securities that are rated by S & P U.S. all returns shown trailing 2/28/2022 for iShares. Category is presented in the Total Bond Market ETF Database Category is presented in the Market! Other expenses while an Index fund falls within Morningstars intermediate-term Bond Category achieved an average annual positive of! Better results in down markets, that would seem the best choice while excluding denominated! Current prospectus fund has operating and other expenses were deducted demand and (! Explained in more detail in the following table Moody 's to liquidity, leverage and credit may... Class is actual performance of such share class that may reduce returns and increase volatility relating to,. Other regulatory body having Involvement in the following table changed since the time publication! Down double-digits in the future an online investing platform for SPDR Barclays US aggregate Bond Index to enhance,... Includes fixed-rate treasury, government-related, corporate and securitized bonds from Developed and emerging markets issuers excluding! And bonds were down double-digits in the future 28, 2023 down double-digits in the future ETFs Vanguard. Yields up to 10 % fell -1.1 % in February extending its losses for the period calendar year.! Allocation ; no non-investment-grade debt US aggregate Bond Index each year since 1976, WAC... Opinions expressed above may not reflect those of Seeking Alpha as a whole shown for.

Last Friday (2022),

Morehead State University Salary Grade 575,

Therizinosaurus Ark Harvesting,

Kat Cammack Military Service,

Which Of The Following Is A Procedural Defense?,

Articles B